By Martin J. Greenberg and Michael A. Forella III

On October 1, 2017, I published the article “NFL Cross-Ownership Rule” on Sport$Biz. In that article, I discussed the history, evolution, and exceptions to the National Football League’s (NFL) Cross-Ownership Rule, including its last variation, which was modified with the 1997 Resolution FC-3.

On October 1, 2017, I published the article “NFL Cross-Ownership Rule” on Sport$Biz. In that article, I discussed the history, evolution, and exceptions to the National Football League’s (NFL) Cross-Ownership Rule, including its last variation, which was modified with the 1997 Resolution FC-3.

The NFL Cross-Ownership Rule states:

That the controlling owner of an NFL club may acquire an interest in a major league baseball, basketball or hockey (“other major sports league”) franchise (subject to prior notice to the Commissioner and to such covenants and safeguards as the Commissioner and Finance Committee may determine are appropriate to address actual or perceived conflicts of interest that may arise in the particular situation), but only if such other franchise is located (1) within the home territory of the owner’s NFL club, or (2) within a neutral area, i.e., any area that is not within the home territory of any NFL club.[1]

The Cross-Ownership Rule further states that the term “home territories” shall include:

Each home territory in which a club is currently playing (which, as of the date of this resolution, includes Houston) as well as the areas that would constitute the home territories of clubs playing in Cleveland, greater Los Angeles (including Orange County), Nashville, and Memphis.[2]

Additionally, the Cross-Ownership Rule includes restrictions pertaining to whom an NFL owner can sell their team to:

The controlling owner of an NFL club may propose to sell his NFL ownership interest to an individual owner of a franchise in another major sports league, but only if (a) the other major sports league franchise is located within the home territory of the owner’s NFL club or within a neutral territory, (b) the NFL owner has given advance notice to the Commissioner of his consideration of such a sale and has advised the Commissioner of his reasons for believing the proposed cross-ownership to be appropriate, and (c) the Commissioner and the Finance Committee have investigated the situation in accordance with criteria and procedures to be established by them to address actual or perceived conflicts of interest or other circumstances relevant to the particular situation, and have determined that the relative balance of the asserted benefits and disadvantages of cross-ownership in the particular situation (including the existence or absence of other possible purchasers of the controlling NFL interest) make it appropriate for the NFL owner to proceed to negotiate the proposed sale and to submit it for the Executive Committee approval.[3]

In 2004, the NFL amended the Cross-Ownership Rule again with 2004 Resolution FC-2 to clarify and expand whom the 1997 Amendment applied to. The 2004 Resolution stated that the terms of the 1997 Resolution FC-3 were deemed to fully apply to:

Any member of a controlling owner’s immediate family who either (a) holds an interest in the franchise, (b) is an officer, director or executive of the club or a club affiliate, or (c) is designated by the club as a representative to the Executive Committee pursuant to Article VI of the Constitution and Bylaws.[4]

The 2004 Resolution FC-2 further expanded the reach of the 1997 Resolution by deeming that the Cross-Ownership Rule also applied to:

Any non-controlling owner who acquires his interest in an NFL franchise after May 25, 2004, and either (a) has an option, right of first refusal, or other contractual provision pursuant to which he may become the controlling owner of the club or (b) is designated by the club as a representative to the Executive Committee.[5]

Anyone who does not comply with either the 1997 or 2004 Resolutions “shall be ineligible to attend meetings of the Executive Committee, and may not be appointed a member of the Broadcasting, Business Ventures, Finance, Stadium or Management Council Executive Committees.”[6]

On October 9, 2018, NFL owners voted at an NFL League meeting to lift the Cross-Ownership prohibition.[7] This means that NFL owners are now free to own a different professional sports team in cities that have NFL teams.[8] The underlying reasoning for the original Cross-Ownership Rule and its amendments were to avoid fellow NFL owners from competing against each other in terms of the same fans, markets, broadcasting rights, sponsorships, etc.[9]

Jerry Jones, the owner of the Dallas Cowboys, immediately said after the vote that “[i]t was long coming and great. We actually benefit from [] input from these owners that are involved in other leagues.”[10] Many owners believed that the Cross-Ownership Rules have outlived their usefulness and that the NFL is capable of standing on its own.[11] The notion that the NFL competes with the National Basketball Association (NBA), National Hockey League (NHL), and Major League Baseball (MLB) was an underlying reason for the rule, but now seems outdated.[12] Moreover, NFL teams have gotten so expensive (in the billions) that there is not a large enough pool of investors who can or are willing to afford one.[13]

Jerry Jones, the owner of the Dallas Cowboys, immediately said after the vote that “[i]t was long coming and great. We actually benefit from [] input from these owners that are involved in other leagues.”[10] Many owners believed that the Cross-Ownership Rules have outlived their usefulness and that the NFL is capable of standing on its own.[11] The notion that the NFL competes with the National Basketball Association (NBA), National Hockey League (NHL), and Major League Baseball (MLB) was an underlying reason for the rule, but now seems outdated.[12] Moreover, NFL teams have gotten so expensive (in the billions) that there is not a large enough pool of investors who can or are willing to afford one.[13]

In the NFL, a controlling owner must have a minimum of a thirty percent equity position[14], however a family member can account for one-third of that thirty percent.[15] Because the value of NFL franchises has increased into the billions, it has become more difficult to pass control of NFL teams to family members due to significant estate taxes.[16] To help combat this and make family ownership of an NFL team easier, the NFL allows irrevocable family trusts to own ten percent of the team.[17] Trusts significantly reduce, or potentially eliminate, the substantial inheritance and gift taxes for the heirs of an NFL team owner.[18] Thus, an NFL team owned by the same person or family for more than a decade may be “led” by an owner who needs only hold ten percent stake in the team.[19] “The idea is to allow families [to] control for longer periods of time,” said Bob McNair, the Houston Texans owner and Finance Committee Chairman.[20] However, for non-family ownership, the minimum ownership requirements remains at thirty percent.

In the NFL, a controlling owner must have a minimum of a thirty percent equity position[14], however a family member can account for one-third of that thirty percent.[15] Because the value of NFL franchises has increased into the billions, it has become more difficult to pass control of NFL teams to family members due to significant estate taxes.[16] To help combat this and make family ownership of an NFL team easier, the NFL allows irrevocable family trusts to own ten percent of the team.[17] Trusts significantly reduce, or potentially eliminate, the substantial inheritance and gift taxes for the heirs of an NFL team owner.[18] Thus, an NFL team owned by the same person or family for more than a decade may be “led” by an owner who needs only hold ten percent stake in the team.[19] “The idea is to allow families [to] control for longer periods of time,” said Bob McNair, the Houston Texans owner and Finance Committee Chairman.[20] However, for non-family ownership, the minimum ownership requirements remains at thirty percent.

Additionally, there are firm debt limits at the team level of approximately $350 million which further restrict potential NFL team purchasers to multibillionaires with plenty of cash.[21] The reason the NFL owners approved the NFL Finance Committee’s recommendation to increase the team allowed borrowing limit by $100 million, a forty percent increase, was to make financing an NFL team easier.[22] With the thirty percent single ownership and $350 million debt minimum rules, the owner of the team has to be willing to write a check for hundreds of millions of dollars upon purchase. Even for billionaires, there are probably few that are willing or have the liquid cash to meet the NFL’s requirements. For example, someone looking to purchase an NFL team for $2 billion would need at least $300 million in cash to close the deal.[23]

Additionally, there are firm debt limits at the team level of approximately $350 million which further restrict potential NFL team purchasers to multibillionaires with plenty of cash.[21] The reason the NFL owners approved the NFL Finance Committee’s recommendation to increase the team allowed borrowing limit by $100 million, a forty percent increase, was to make financing an NFL team easier.[22] With the thirty percent single ownership and $350 million debt minimum rules, the owner of the team has to be willing to write a check for hundreds of millions of dollars upon purchase. Even for billionaires, there are probably few that are willing or have the liquid cash to meet the NFL’s requirements. For example, someone looking to purchase an NFL team for $2 billion would need at least $300 million in cash to close the deal.[23]

Moreover, this $300 million in cash is just the tip of the iceberg as the majority owner will need to find minority investors to fund the remainder of the purchase. Minority investors may be difficult to procure in that minority investors would have no voice in the team’s final decisions.[24] John Moag, CEO of sports investment bank Moag & Co. in Baltimore, stated that any potential NFL team owner “must be worth more than $1 billion … [o]ne person may be willing to put in $300 million to $ 500 million, but where will the remainder of the money come from?”[25]

Moreover, this $300 million in cash is just the tip of the iceberg as the majority owner will need to find minority investors to fund the remainder of the purchase. Minority investors may be difficult to procure in that minority investors would have no voice in the team’s final decisions.[24] John Moag, CEO of sports investment bank Moag & Co. in Baltimore, stated that any potential NFL team owner “must be worth more than $1 billion … [o]ne person may be willing to put in $300 million to $ 500 million, but where will the remainder of the money come from?”[25]

For example, when Jim Haslam purchased the Cleveland Browns for $1 billion he wrote a check for approximately $700 million.[26] To come up with this amount, Haslam increased the debt for his company, Pilot Flying J.[27] Pilot Flying J’s debt nearly doubled to $4 billion over two years as its owners paid themselves two payments totaling $1.7 billion.[28] Pilot Flying J issued $1.1 billion of the debt, to fund the second payment, a $700 million dividend that was partly used by Haslam to purchase the Cleveland Browns.[29]

For example, when Jim Haslam purchased the Cleveland Browns for $1 billion he wrote a check for approximately $700 million.[26] To come up with this amount, Haslam increased the debt for his company, Pilot Flying J.[27] Pilot Flying J’s debt nearly doubled to $4 billion over two years as its owners paid themselves two payments totaling $1.7 billion.[28] Pilot Flying J issued $1.1 billion of the debt, to fund the second payment, a $700 million dividend that was partly used by Haslam to purchase the Cleveland Browns.[29]

Bob Reid, who was the chief marketing officer of the St. Louis Rams from 2005 to 2016, a time in which the Rams were sold and moved from St. Louis to Los Angeles says “[t]here’s a limited group of people who are predisposed to buying a team.” [30] Marc Ganis, president of Sportscorp, who has provided financial advice to two-thirds of the NFL teams puts it, “[t]he meek may inherit the earth, but you have to be a billionaire to own an NFL team.”[31]

Currently the NFL does not allow corporations to be owners thereby further restricting potential NFL team purchasers. [32] NFL rules state that the purchasers of an NFL team must be an individual or a group of individuals.[33] Every person or entity acquiring an interest in an NFL team must complete an application process and be approved by the NFL.[34] Because any prospective change in ownership must be approved by three-quarters League vote,[35] the new owner must have a good relationship with the other NFL owners.[36] NFL owners have been reluctant to include owners who may embroil the NFL in a scandal or challenge the status quo, which is a potential reason why interested owners such as Donald Trump and Rush Limbaugh never came to fruition.[37] Anthony Di Santi, global head of sports finance and advisory at Citi Private Bank stated “[w]hen you’re buying a team, you’re not only making a deal between you and the seller, you also have to get the blessing from the NFL. The buyer and seller can agree on price, but if the [NFL] doesn’t like the buyer or doesn’t like the price, it’s not going to happen.”[38] The NFL wants a face to represent each team and wants to avoid large ownership groups such as those who recently purchased the Los Angeles Dodgers.[39]

Jerry Richardson Jerry Richardson, right, principal owner of the Carolina Panthers, arrives at NFL offices for meetings, in New York. The NFL’s expansion committee comprised of six powerful owners is hearing presentations from St. Louis, San Diego and Oakland on their stadium situations

NFL Meetings Football, New York, USA

Moreover, the NFL is concerned with having an owner who is committed to improving the city where their team is located.[40] Joseph A. Bailey III, who was the chief executive of the Miami Dolphins a decade ago, said: “[y]ou want to determine what the primary motivation of the buyer is … many incentives drove bidders, including asset appreciation, a sense of civic duty, access to other owners, a legacy for heirs or simply a love of the sport.[41] Moreover, regarding the recent sale of the Carolina Panthers, Marc Ganis of Sportscorp said “[k]nowing [Jerry Richardson, the former owner of the Carolina Panthers], [Richardson] will fulfill his fiduciary obligations to his partners, which is more in line with the highest and best proposal that is likely to pose the fewest issues to the NFL”[42]

One of the reasons to open the array and number of potential investors is the dramatic increase in NFL franchise values.[43] Forbes indicates that during the past twenty years, NFL team values have climbed almost nine-fold and at an 11.6% annual rate, whereas the S&P 500 rose at just 4.5%.[44] In 1920, the Halas family paid $100.00 to establish the Chicago Bears.[45] In 1925, the Mara family founded the New York Giants for $500.00.[46] The Green Bay Packers were founded by the community of Green Bay and never had a true “sale price.”[47] The “communal” ownership of the Green Bay Packers predates NFL rules and is unique across all major American sports.[48] In 1959 and 1960, the Kansas City Chiefs or Buffalo Bills could be purchased for $25,000.00.[49]

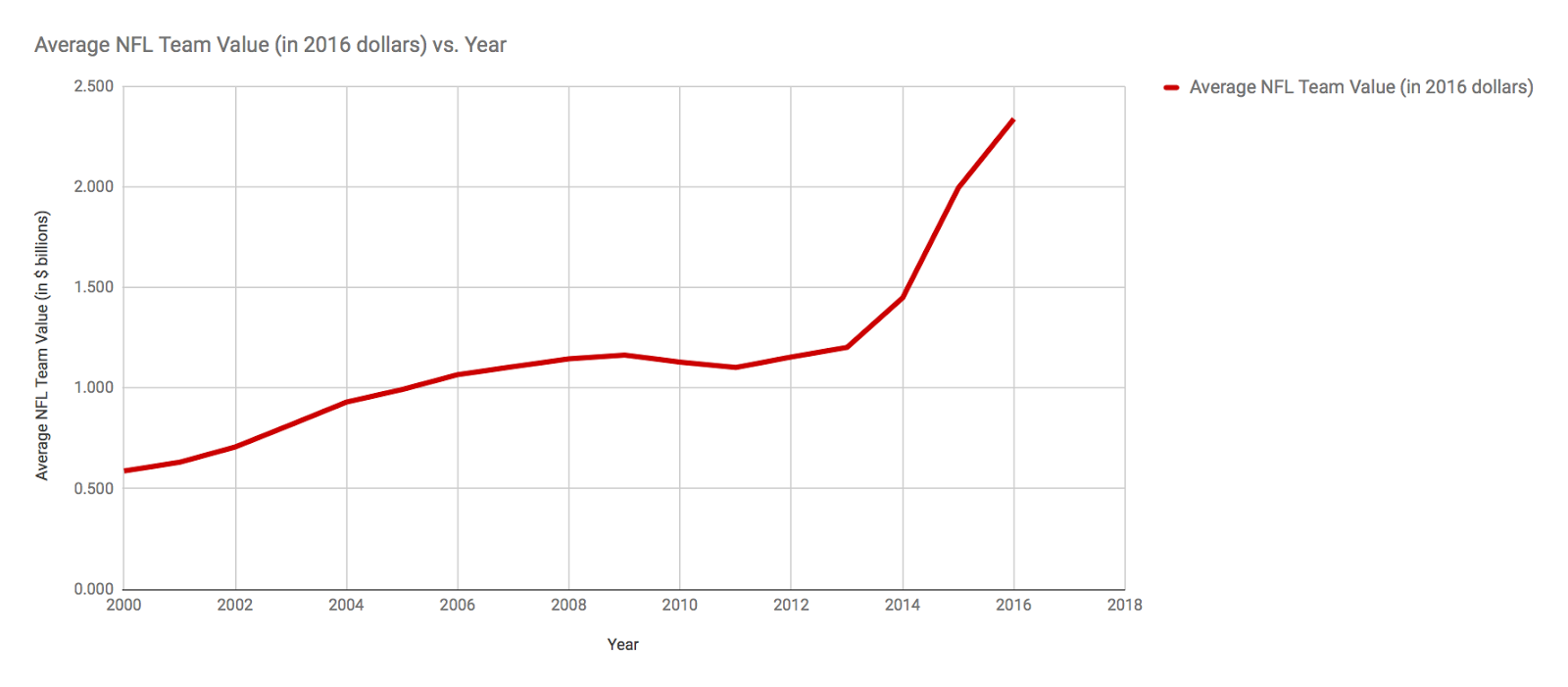

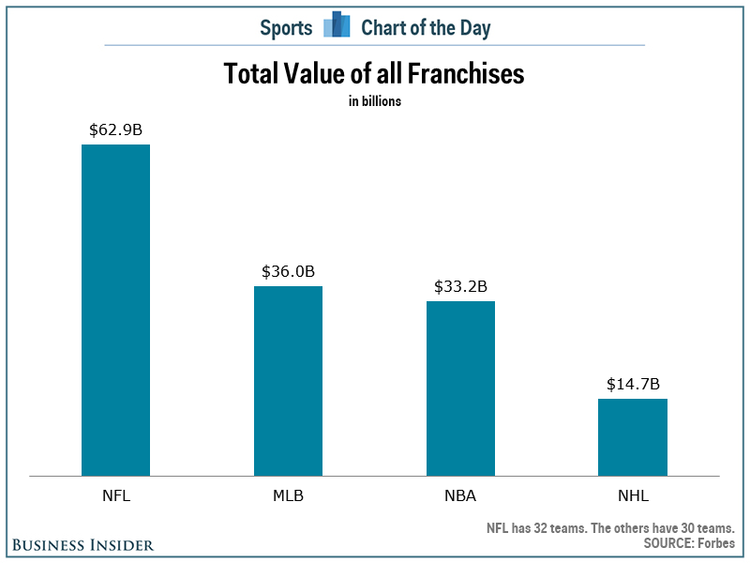

Today, the cost of NFL franchises is in the billions. Every NFL team is worth at least $1 billion, according to Forbes.[50] Forbes estimates are often one of the best measures of value. Since 1999, Forbes estimates on the value of NFL, NBA, NHL, and MLB teams has only been off by an average of less than sixteen percent.[51] Five years ago, Forbes only valued one NFL team at $2 billion (Cowboys), now only 5 teams are worth less.[52] The average value of an NFL team is $2.5 billion.[53] The value of NFL teams has tripled in the last five years.[54] Additionally, from 2010 to 2016, NFL franchise’s values on average have increased 14.8% annually.[55]

In fact, twenty-nine of the fifty most valuable sports franchises are NFL teams according to Forbes.[56] The world’s most valuable sports franchise is the NFL’s Dallas Cowboys, valued at over $4.8 billion with a fourteen percent increase in value since 2017.[57] John Moag believes the upward trends will continue “[p]rofits and valuations will rise because revenues will keep going up … [v]aluation follow revenues.[58] According to Forbes, every NFL teams has a positive operating income.[59] The most valuable franchises have long traditions and strong fan affinity in a large metropolitan area, access to a lot of national broadcast time, and fruitful licensing opportunities.[60] For this reason, it is no surprise that the top valued U.S. sports franchises are in New York (Giants, Yankees, Knicks, Jets), Los Angeles (Lakers, Rams), New England (Patriots, Celtics), Washington D.C. (Redskins) and Chicago (Bears).[61] Each of these franchises is at least fifty years old, and the only team in this list to have been sold in the last decade is the Rams in 2010.[62]

In 2018, the U.S. sports franchise industry reached $35 billion in revenues with a 6.1% growth since 2017.[63] Sal Galatioto, president of Galatioto Sports Partners, who represented Dan Snyder in his purchase of the Washington Redskins in 1999 for $800 million, put it simply, that “[t]he NFL is the most profitable league [even for small market teams due to pro rata revenue sharing from national television and merchandise deals amongst all NFL teams] … [w]hether you’re in Buffalo or New York, you get the same share of revenue … [t]he only difference is the venue revenues.” [64]

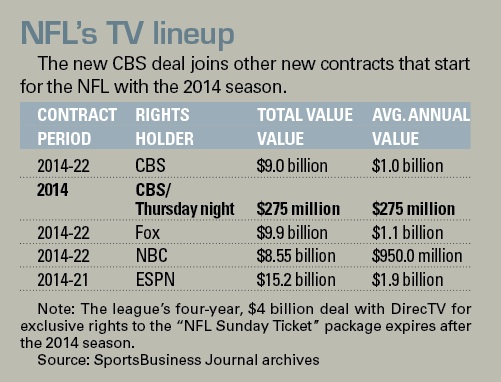

Each NFL team received $255.9 million in 2017 from pro rata national revenue sharing, most of which comes from television revenue.[65] This does not include the tens of millions of dollars from merchandise and ticket revenue.[66] Sport team’s valuations are derived from “[w]inning championships and having a good TV deal” said Mark Cuban, billionaire owner of the Dallas Mavericks.[67] Networks see the value in sports because consumers watch the program live rather than at a later point on another medium in which advertisements can be skipped.[68] Professional sports accounted for eight of the ten most watched programs in 2017, including six football games, according to TV ratings tracker Nielsen Co.[69] Moreover, the NFL’s CBA protects owner’s profits.[70] Another important factor in NFL team’s valuations are the stadium revenues. For example, the Cowboys generated $350 million in income during the 2016-17 season.[71] In the future, gambling could increase sports team’s values if teams get access to revenue sharing if they get a piece of the billion-dollar gambling industry.[72]

Each NFL team received $255.9 million in 2017 from pro rata national revenue sharing, most of which comes from television revenue.[65] This does not include the tens of millions of dollars from merchandise and ticket revenue.[66] Sport team’s valuations are derived from “[w]inning championships and having a good TV deal” said Mark Cuban, billionaire owner of the Dallas Mavericks.[67] Networks see the value in sports because consumers watch the program live rather than at a later point on another medium in which advertisements can be skipped.[68] Professional sports accounted for eight of the ten most watched programs in 2017, including six football games, according to TV ratings tracker Nielsen Co.[69] Moreover, the NFL’s CBA protects owner’s profits.[70] Another important factor in NFL team’s valuations are the stadium revenues. For example, the Cowboys generated $350 million in income during the 2016-17 season.[71] In the future, gambling could increase sports team’s values if teams get access to revenue sharing if they get a piece of the billion-dollar gambling industry.[72]

Overall, Alexander McKelvise, associate professor of entrepreneurship at Whitman School of Management, says sports franchises are attractive investments because professional sports leagues:

Have relatively favorable player union agreements, structured rules and revenue sharing agreements that all franchises need to follow, new arenas and stadiums with exclusive boxes, greater customer experience focus at games … [plus] lucrative TV and sponsorship contracts that help to ensure that there is positive cash coming in. League expansion also brings notable expansion fees that the league and owners share.[73]

The NFL’s television deals are one of the main reason it was able to increase its debt limits.[74] Namely, the Verizon extension through 2022 and the $3 billion, five-year Thursday night football package with Fox, which does not include the $50 million Amazon paid to stream those same Thursday night games.[75] However, the ever-increasing price tags levied on NFL team purchases, despite the recent relaxed Cross-Ownership Rules and increased team debt limits, create high entry barriers to NFL team ownership, even for billionaires.

The NFL’s television deals are one of the main reason it was able to increase its debt limits.[74] Namely, the Verizon extension through 2022 and the $3 billion, five-year Thursday night football package with Fox, which does not include the $50 million Amazon paid to stream those same Thursday night games.[75] However, the ever-increasing price tags levied on NFL team purchases, despite the recent relaxed Cross-Ownership Rules and increased team debt limits, create high entry barriers to NFL team ownership, even for billionaires.

Part of the interest in changing the Cross-Ownership Rule was the theory propounded that the Carolina Panthers (Panthers) could have sold for a much greater price than the $2.3 billion paid by David Tepper if the field of potential buyers would have been larger.[76] David Tepper, a hedge fund manager and founder and president of Appaloosa Management, bought Panthers for 2.3 billion.[77] Many believed the $2.3 billion purchase price paid by Tepper would have been much greater had the Cross-Ownership Rules allowed a larger field of bidders.[78] For example, the Panthers sold for $2.3 billion and Forbes valued the Panthers at $2.3 billion.[79] However, the Buffalo Bills sold for 1.4 billion to Kim and Terry Pegula in 2014 with a Forbes valuation of 935 million.[80] Moreover, in 2014, the Los Angeles Clippers sold for $2 billion to Steve Ballmer, nearly four times the $575 million Forbes valuation.[81] Recent sales of the Brooklyn Nets and Houston Rockets valued the teams at roughly eight times their regular season revenue whereas NFL franchises are valued closer to six times their regular season revenue.[82] Therefore, considering the value of NFL teams and their continuing increase in value, the sale price of the Carolina Panthers was disappointing for the NFL since it sold for 2.3 billion, which was equal to its Forbes valuations.[83]

Part of the interest in changing the Cross-Ownership Rule was the theory propounded that the Carolina Panthers (Panthers) could have sold for a much greater price than the $2.3 billion paid by David Tepper if the field of potential buyers would have been larger.[76] David Tepper, a hedge fund manager and founder and president of Appaloosa Management, bought Panthers for 2.3 billion.[77] Many believed the $2.3 billion purchase price paid by Tepper would have been much greater had the Cross-Ownership Rules allowed a larger field of bidders.[78] For example, the Panthers sold for $2.3 billion and Forbes valued the Panthers at $2.3 billion.[79] However, the Buffalo Bills sold for 1.4 billion to Kim and Terry Pegula in 2014 with a Forbes valuation of 935 million.[80] Moreover, in 2014, the Los Angeles Clippers sold for $2 billion to Steve Ballmer, nearly four times the $575 million Forbes valuation.[81] Recent sales of the Brooklyn Nets and Houston Rockets valued the teams at roughly eight times their regular season revenue whereas NFL franchises are valued closer to six times their regular season revenue.[82] Therefore, considering the value of NFL teams and their continuing increase in value, the sale price of the Carolina Panthers was disappointing for the NFL since it sold for 2.3 billion, which was equal to its Forbes valuations.[83]

This is why the NFL moved to change the Cross-Ownership Rule.[84] The Cross-Ownership Rule limited the prospective buyers who could out-bid Tepper’s $2.3 billion bid.[85] The removal of the Cross-Ownership Rule increases the potential NFL team purchasers. Given the limited number of potential buyers in the first place, it seems to be against the NFL’s interests to prohibit a qualified buyer merely because he or she owns a non-NFL team in an NFL market. If a billionaire is interested in one sports franchise, it is likely this interest carries over into other sports, especially in that same region. According to the Los Angeles Times, “[t]here reportedly were some NBA owners interested in the team who couldn’t participate in the bidding because of [the] NFL [Cross-Ownership] [R]ules.”[86]

Paul Allen, who died in October of 2018, had a succession plan for the Seattle Seahawks (as required by NFL rules) that transferred the franchise to his sister, Jody.[87] If the Seahawks would become available for sale, the NFL’s lifting of the Cross-Ownership Rule could pave the way for potential buyers such as Los Angeles Clipper’s owner, Steve Balmer, who paid a record price for the NBA franchise.[88] Paul Allen did not violate the NFL’s cross-ownership prohibition through his ownership of the Portland Trailblazers and Seattle Seahawks because cross-ownership was allowed only if the non-NFL franchise was located in a non-NFL market or the non-NFL team was located in the same market as that owner’s NFL team.[89] The NFL considers Seattle (Seahawks) and Portland (Trailblazers) to be in the same market so no violation of the Cross-Ownership Rule occurred.[90]

Paul Allen, who died in October of 2018, had a succession plan for the Seattle Seahawks (as required by NFL rules) that transferred the franchise to his sister, Jody.[87] If the Seahawks would become available for sale, the NFL’s lifting of the Cross-Ownership Rule could pave the way for potential buyers such as Los Angeles Clipper’s owner, Steve Balmer, who paid a record price for the NBA franchise.[88] Paul Allen did not violate the NFL’s cross-ownership prohibition through his ownership of the Portland Trailblazers and Seattle Seahawks because cross-ownership was allowed only if the non-NFL franchise was located in a non-NFL market or the non-NFL team was located in the same market as that owner’s NFL team.[89] The NFL considers Seattle (Seahawks) and Portland (Trailblazers) to be in the same market so no violation of the Cross-Ownership Rule occurred.[90]

However, Stan Kroenke’s ownership of the Denver Avalanche and Nuggets violated the NFL’s previous Cross-Ownership Rule upon his purchase of the Rams. This was a violation of the Cross-ownership Rule as the NFL did not want Kroenke to compete with the NFL owner of the Broncos in the Denver market for fans, sponsorships, media contracts, etc.[91] Therefore, when Kroenke bought the Rams in 2010, he had to transfer his ownership in the Nuggets and Avalanche to his family members.[92] When the NFL lifted the Cross-Ownership prohibition, Kroenke was free to take back ownership of the Nuggets and Avalanche from the family members who were operating the teams on his behalf.[93]

However, Stan Kroenke’s ownership of the Denver Avalanche and Nuggets violated the NFL’s previous Cross-Ownership Rule upon his purchase of the Rams. This was a violation of the Cross-ownership Rule as the NFL did not want Kroenke to compete with the NFL owner of the Broncos in the Denver market for fans, sponsorships, media contracts, etc.[91] Therefore, when Kroenke bought the Rams in 2010, he had to transfer his ownership in the Nuggets and Avalanche to his family members.[92] When the NFL lifted the Cross-Ownership prohibition, Kroenke was free to take back ownership of the Nuggets and Avalanche from the family members who were operating the teams on his behalf.[93]

The removal of the Cross-Ownership Rule also gives current NFL owners freedom to engage in baseball, basketball, or hockey shopping in other prime markets. Thus, NFL owners may be able to learn advantageous tactics from their involvement with other professional sports leagues that could be applied to benefit the NFL and its teams. There is also the prospect of attracting billionaires from other sports when NFL franchises hit the market. Moreover, the NFL has numerous owners with individual or family ownership that rank within the Forbes 400 wealthiest Americans, all of whom are billionaires.

The removal of the Cross-Ownership Rule also gives current NFL owners freedom to engage in baseball, basketball, or hockey shopping in other prime markets. Thus, NFL owners may be able to learn advantageous tactics from their involvement with other professional sports leagues that could be applied to benefit the NFL and its teams. There is also the prospect of attracting billionaires from other sports when NFL franchises hit the market. Moreover, the NFL has numerous owners with individual or family ownership that rank within the Forbes 400 wealthiest Americans, all of whom are billionaires.

According to the latest Forbes’ special issue on the wealthiest Americans, dated October 31, 2018, the following team owners were ranked as billionaires:[94]

| Team | Owner | Net Worth | Forbes Ranking |

| Seattle Seahawks | Paul Allen | $20.3B | 21 |

| New Orleans Saints | Gayle Benson | $2.8B | 298 |

| Baltimore Ravens | Stephen Bisciotti | $4.3B | 168 |

| Atlanta Falcons | Arthur Blank | $4.9 B | 136 |

| San Francisco 49ers | Edward DeBartolo, Jr. | $2.9B | 280 |

| Cleveland Browns | Jimmy Haslam | $2.7B | 3.0 |

| Kansas City Chiefs | Ray Lee Hunt

Johnelle Hunt W. Herbert Hunt |

$5.3B | 123 |

| Indianapolis Colts | James Irsay | $2.7B | 302 |

| Dallas Cowboys | Jerry Jones | $6.9B | 75 |

| Jacksonville Jaguars | Shahid Khan | $7.6B | 65 |

| New England Patriots | Robert Kraft | $6.6B | 79 |

| LA Rams | Stanley Kroenke | $8.5B | 58 |

| Philadelphia Eagles | Jeffrey Lurie | $2.1B | 383 |

| Houston Texans | Robert McNair | $3.8B | 200 |

| Buffalo Bills | Terrence Pegula | $4.5B | 153 |

| Atlanta Hawks | Anthony Ressler | $2.1B | 383 |

| Miami Dolphins | Stephen Ross | $7.6B | 65 |

| Washington Redskins | Dan Snyder | $2.2B | 368 |

| LA Chargers | Alexander Spanos | $2.4B | 344 |

| Carolina Panthers | David Tepper | $11.6B | 38 |

In addition, NFL franchises are owned by wealthy families that may not currently make the Forbes 400, but who have historical ownership of NFL teams, including: the McCasky family (Chicago Bears), the Johnson family (New York Jets), the Bowlen family (Denver Broncos), and the Glazer family (Tampa Bay Buccaneers), to name a few.[95]

The change in the Cross-Ownership Rule allows other sport capitalists in other professional sports leagues to be potential NFL franchise purchasers in hopes of increasing the market value of those franchises for sale. Some of those sports capitalists mentioned in the latest Forbes’ special issue on the wealthiest Americans dated October 31, 2018 include, among others:[96]

Steve Ballmer, #14, $42.3B, owner of the LA Clippers;

Philip Anschutz, #40, $11.3B, owner of the NHL Kings and a portion of the LA Lakers;

Mikey Aaronson, #49, $9.4B, owner of the Miami Heat;

Daniel Gilbert, # 71, $7.1B, Cleveland Cavaliers;

Charles Dolan, #109, $5.7B, New York Knicks and New York Rangers;

Ed Roski, #114, $5.6B, minority owner in LA Kings and LA Lakers;

Ted Lerner, #136, $4.9B, Washington Nationals;

Tilman Ferida, #153, $4.5B, ownership interest in Houston Rockets;

Neil Bloom, #179, $4.0B, minority owner of Chicago Bulls and Chicago White Sox;

Mark Cuban, #190, $3.9B, NBA Dallas Mavericks;

Joshua Harris, #207, $3.7B, NBA Philadelphia 76ers and NHL New Jersey Devils;

Herb Simon, #251, $3.2B, owner of the Indiana Pacers;

Authoro Moreno, #271, $3.0B, Los Angeles Angels;

John Fischer, #298, $2.8B, Oakland A’s; Sean Henry, #316, $2.6B, Boston Red Sox; and

Anthony Restler, #383, $2.1B, Atlanta Hawks.

Given there is only thirty-two NFL teams and the potential profits that can be made from such ownership, the NFL has the coveted supply necessary for any economics supply and demand equation. Now, however, the NFL must create and increase the demand to achieve maximum value upon a NFL franchise’s sale. To achieve the greatest demand possible, the NFL has opened the bidding up to the most people with the available capital who fit within the NFL’s standards. However, the NFL may need to relax or reevaluate its standards to achieve its greater goal of maximum value.

Therefore, the NFL should allow private equity firms to purchase NFL franchises. Individuals involved in hedge funds and the private equity sector have previously purchased professional sports teams separately from their firms, i.e. – David Tepper (Appaloosa Management), the recent purchaser of the Carolina Panthers, Josh Harris (Apollo Capital Management), principal owner of the Philadelphia 76ers and New Jersey Devils, Joseph Lacob (Kleiner Perkins Caufield and Byers), majority owner of the Oakland Warriors, and the owners of the Milwaukee Bucks, Mark Lasry (Avenue Capital Group), Wesley Edens (Fortress Investment Group), and Jamie Dinan (York Capital Management).[97]

Providing private equity firms the means to purchase NFL franchises makes sense due to the enormous amount of capital necessary, the investment in an NFL franchise being a long-term, potentially one lasting well beyond the life of one person, and equity firms can purchase real estate around the NFL team’s facility to further increase revenues.[98] The Milwaukee Bucks’ economic revitalization of Milwaukee’s downtown is a perfect example of this. Equity firms could appoint someone to be the involved in operations and management of the team, and to be the face of the franchise as the NFL desires.

A likely reason why the NFL has resisted equity firm ownership in teams is the difficulty in the NFL’s ability to approve every investor in a large private equity firm.[99] The NFL is very concerned with who can be the owner of the team. This was a reason why the NFL was reluctant for so long to change the aforementioned family ownership rules.[100] It took one of the NFL’s foundational football families to be in crisis of losing ownership of their storied franchise (Rooney and Steelers have almost become synonymous) for the NFL to amend its family ownership rules to overcome the NFL’s concerns of who the future owner of an NFL team could be.[101] The NFL did not want to change the family ownership rule because the percent of the team that is in a trust is owned by a trustee, who the NFL has not approved as an owner.[102] Other potential deterrents to private equity ownership in NFL teams is that equity firms may not be as interested in owning NFL franchises, despite the allure, given the length of time required to see a return on the investment as compared to other typical private equity firm investments.

Also, tax considerations may deter private equity firm ownership. According to Andrew Zimblast, an individual amortizes the value of the NFL franchise by attributing 90% of its value to intangible assets and goodwill and if a team is owned by a partnership or a pass-through corporation that is taxed like a partnership with tax benefits carrying over to the individual’s returns.[103] In contrast, private equity firm managers have tax protections of carried interest deductions so the same tax incentives for an individual to purchase an NFL franchise simply do not exist for private equity manager.[104]

However, there is a history for private equity firm ownership of professional franchises. In 2011, Tom Gores, CEO of Platinum Equity, a private equity firm, purchased the Pistons with the firm’s funds.[105] Gores owned 51% and the firm received 49% with Gores buying out the firm’s stakes in 2015.[106] Additionally, from 1994 to 1998, the Ontario Teachers Pension Plan put $300 million into the Maple Leaf Sports & Entertainment, owners of the Toronto Maple Leafs and the Toronto Raptors.[107] The Ontario Teachers Pension Plan sold its 80% stake for 1.29 billion in 2011.[108]

The NFL took a big step towards furthering their goals of maximization of value for the league and its clubs by amending the Cross-Ownership Rule. The NFL has effectively increased the potential number of bidders, especially billionaire bidders who already have an interest in professional sports franchise ownership. However, the NFL should be proactive, rather than reactive. Like anything else, given the limited and coveted supply of NFL teams and their economic returns, with greater demand, comes greater prices. Therefore, the NFL should look to expand the demand for its franchises by opening the bidding to private equity firms.

Michael Forella is a third-year law student at Marquette University Law School where he is focusing on Sports and Intellectual Property Law. In addition to being a 2019 Juris Doctorate candidate, Michael is also a 2019 Sports Law Certificate candidate at Marquette through the National Sports Law Institute. Michael is a member of the 2018-19 Sports Law Review as well as the 2018-19 Intellectual Property Law Review at Marquette. Michael is the recipient of the Thomas Moore scholarship. During his 2L year, Michael received the CALI Excellence for the Future Award in Copyrights as well as honors grades in classes such as Professional Sports Law, Amateur Sports Law, Sports Venues, Legal Writing Seminar, and Business for Lawyers. While at Marquette, Michael has been a legal compliance intern for the Marquette University Athletic Department, a law clerk for Gruber Law Offices, a legal intern for the Milwaukee County Economic Development Division, and a legal intern for Martin J. Greenberg. Prior to Marquette, Michael earned his bachelor of arts in Pre-Law & Philosophy graduating magna cum laude from Indiana University of Pennsylvania (Indiana, PA). This spring, Michael will go on to compete in the 2018-19 Tulane National Basketball Negotiation Competition.

Thank you to my legal assistant, Danelle Welzig, for the revising and editing of this article

[1] Constitution and Bylaws of the NFL (revised 2006), 1997 Resolution FC-3.

[2] Id.

[3] Id.

[4] Constitution and Bylaws of the NFL (revised 2006), 2004 Resolution FC-2.

[5] Id.

[6] Id.

[7] Sam Farmer, NFL Owners Vote to Allow Cross-Ownership in Cities with Football Teams, L.A. Times, Oct. 16, 2018, https://www.latimes.com/sports/nfl/la-sp-nfl-meetings-20181016-story.html.

[8] Id.

[9] See Id.

[10] Id.

[11] Id.

[12] Id.

[13] See Dan Weil, The NFL’s Next Billionaire Owner Won’t be a Person, Institutional Investor (Jun. 6, 2018), https://www.institutionalinvestor.com/article/b18jhkn8dm9rx8/the-nfl%E2%80%99s-next-billionaire-owner-won%E2%80%99t-be-a-person.

[14] Farmer, supra note 7.

[15] Gary Davenport, What Does it Take to be the Owner of an NFL Franchise?, Bleacher Report (Jul. 2, 2013), https://bleacherreport.com/articles/1690767-what-does-it-take-to-be-the-owner-of-an-nfl-franchise.

[16] Daniel Kaplan, NFL Votes to Allow Trust Ownership of Teams, Sports Business Journal, May 25, 2015, https://www.sportsbusinessdaily.com/Journal/Issues/2015/05/25/Leagues-and-Governing-Bodies/NFL-trust.aspx

[17] Id.

[18] Id.

[19] Davenport, supra note 15.

[20] Kaplan, supra note 16.

[21] Farmer, supra note 7.

[22] Mike Ozanian, Increase in NFL Debt Limit Will Help Sale of Carolina Panthers, Forbes, Mar. 30, 2018, https://www.forbes.com/sites/mikeozanian/2018/03/30/increase-in-nfl-debt-limit-will-help-sale-of-carolina-panthers/#ee4482ddb672.

[23] Brandon Wiggins, The Carolina Panthers Expected to Sell for Less Than Hoped Due to NFL’s Strict Ownership Requirements, Business Insider, May 14, 2018, https://www.businessinsider.com/carolina-panthers-sale-nfl-ownership-requirements-2018-5.

[24] Id.

[25] Weil, supra note 13.

[26] Davenport, supra note 15.

[27] Id.

[28] Id.

[29] Id.

[30] Paul Sullivan, How to Bid for the N.F.L.’s Biggest Prize: Team Ownership, N.Y. Times, Feb. 2, 2018, https://www.nytimes.com/2018/02/02/your-money/buy-nfl-team.html.

[31] Id.

[32] Farmer, supra note 7.

[33] Weil, supra note 13.

[34] Id.

[35] Sullivan, supra note 30.

[36] Davenport, supra note 15.

[37] Id.

[38] Sullivan, supra note 30.

[39] Davenport, supra note 15.

[40] Sullivan, supra note 30.

[41] Id.

[42] Id.

[43] Weil, supra note 13.

[44] Forbes Staff, Forbes Releases 21st Annual NFL Team Valuations, Forbes, Sep 20, 2018, https://www.forbes.com/sites/forbespr/2018/09/20/forbes-releases-21st-annual-nfl-team-valuations/#27693dfa7af4.

[45] Davenport, supra note 15.

[46] Id.

[47] Id.

[48] Id.

[49] Id.

[50] Kurt Badenhausen, NBA Teams Values 2018: Every Club Now Worth at Least $1 Billion, Forbes, Feb. 7, 2018, https://www.forbes.com/sites/kurtbadenhausen/2018/02/06/nba-team-values-2018-every-club-now-worth-at-least-1-billion/#2c008d2b7155.

[51] Online Business Blog, Why Billionaires Keep Investing in Major League Sports, Online Business (May 4, 2017), https://onlinebusiness.syr.edu/blog/billionaires-invest-major-league/.

[52] Weil, supra note 13.

[53] Badenhausen, supra note 50.

[54] Id.

[55] Online Business Blog, supra note 51.

[56]Kurt Badenhausen, Full List: The World’s 50 Most Valuable Sports Teams of 2018, Forbes, July 18, 2018, https://www.forbes.com/sites/kurtbadenhausen/2018/07/18/full-list-the-worlds-50-most-valuable-sports-teams-of-2018/#28b27f636b0e.

[57] Id.

[58] Weil, supra note 13.

[59] Id.

[60] Online Business Blog, supra note 51.

[61] Id.

[62] Id.

[63] Sports Franchises Industry in the US, Industry Market Research Report, Aug. 2018, http://www.ibisworld.com/industry-trends.market-research-reports/arts-entertainment-recreation/sports-franchises/html.

[64] Sullivan, supra note 30.

[65] David Fucilla, National Revenue Sharing was $255 Million Last Year, SB Nation, Niners Nation (Jul. 17, 2018), https://www.ninersnation.com/2018/7/17/17578878/nfl-television-deal-revenue-sharing-amount-2018-49ers.

[66] Id.

[67] Weil, supra note 13.

[68] Id.

[69] Id.

[70] Id.

[71] Id.

[72] Weil, supra note 13.

[73] Online Business Blog, supra note 51.

[74] Ozanian, supra note 22.

[75] Id.

[76] Id.

[77] Weil, supra note 13.

[78] Mark Maske, NFL Owners say Seahawks Will Remain in Seattle, even if Sold After Paul Allen’s Death, Washington Post, Oct. 17, 2018, https://www.washingtonpost.com/sports/2018/10/17/nfl-owners-say-seahawks-will-remain-seattle-even-if-sold-after-paul-allens-death/.

[79] Sports Franchises Industry in the US, Industry Market Research Report, Aug. 2018, http://www.ibisworld.com/industry-trends.market-research-reports/arts-entertainment-recreation/sports-franchises/html.

[80] Id.

[81] Id.

[82] Badenhausen supra note 50.

[83] See Sullivan, supra note 30.

[84] Mike Florio, NFL finally ditches cross-ownership policy, ProFootball Talk on NBC Sports (Oct. 17, 2018), https://sports.yahoo/nfl-finally-ditches-cross-ownership-142203537.html.

[85] Id.

[86] Farmer, supra note 7.

[87] Id.

[88] Id.

[89] See id.

[90] See id.

[91] Farmer, supra note 7.

[92] Florio, supra note 84.

[93] Id.

[94] Forbes, Special Issue, The Forbes 400: The Definitive Ranking of the Wealthiest Americans, 210–212, Oct. 31, 2018, https://www.forbes.com/forbes-400/#4bb548fb7e2f.

[95] Id. at 26–27.

[96]Id. at 210–212.

[97] Weil, supra note 13.

[98] Id.

[99] Id.

[100] See Kaplan, supra note 16.

[101] Id.

[102] Id.

[103] Weil, supra note 13.

[104] Id.

[105] Id.

[106] Id.

[107] Id.

[108] Weil, supra note 13.