In my post dated March 6, 2015 entitled “Jock Tax,” I indicated that Wisconsin Governor Scott Walker proposed using jock taxes to help fund a new Milwaukee Bucks Arena:

Walker announced on January 27, 2015 a plan to issue state bonds for a new Milwaukee arena in an amount not to exceed $220 million dollars. Walker called his plan a common sense, fiscally conservative approach, and a “Pay-Their-Way” plan. The jock tax proposal would not cost the tax payers a penny according to Walker. “We are going to help the Bucks pay their own way to a new arena.” Walker said that the growth in income tax revenues from Milwaukee Bucks players, employees and visiting team, would generate enough money to cover the $220 million in state issued bonds for the arena. Of the $220 million, $20 million will be utilized to pay off existing BMO Harris Bradley Center debt. The $220 million would only be released after $300 million of other funding for the arena had been secured. The extra $50 million of funding would come from the city, county, or from potential land swaps between governments. The new arena is estimated to cost somewhere between $400-500 million.[1]

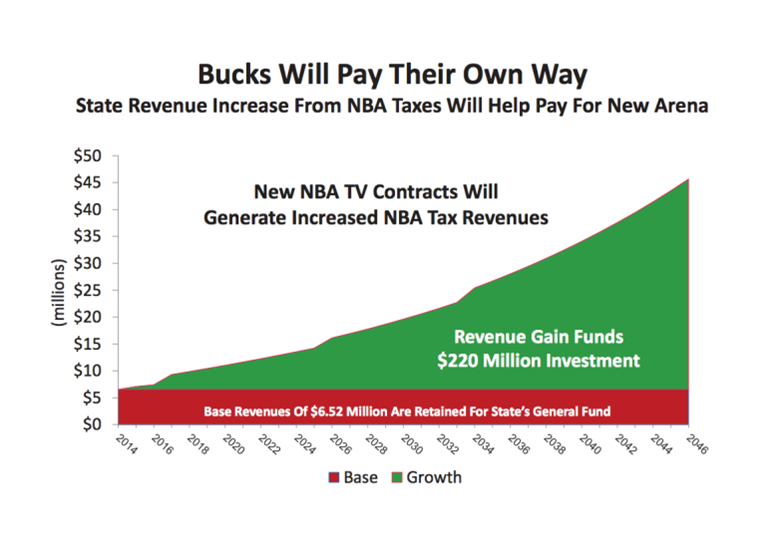

The catalyst for the debt service is the anticipated increase in players salary due in part to huge increases in the amount of money television networks are willing to pay the NBA and its member teams. No current base revenue would be used to pay the bonds and that base has been estimated to be $6.52 million and will continue to go to the general fund.[2]

The Governor’s proposal anticipates income tax on NBA players increasing from $6.52 million in 2014 to $13.55 million by 2024. Walker’s proposed to use the future growth in jock tax revenue from rising base salaries to cover debt service costs for a new Bucks arena. The NBA “signed new television contracts with Walt Disney’s ESPN and Time Warner’s TNT. The NBA and two networks signed a new, nine year deal worth $2.66 billion per year that takes effect during the 2016-2017 season. The league’s current contract with the two networks is worth about $930 million per year.”[3] The new television deal will involve approximately 180% increase from the previous deals.

Wisconsin Governor Scott Walker’s proposal to issue $220 million in bonds toward funding a new Milwaukee Bucks Arena may be in trouble. According to a Legislative Fiscal Bureau Report (“Report”) dated March 24, 2015, Governor Walker’s proposal could ultimately carry a total cost estimated at $488 million including interest, which is approximately $108 million more than a preliminary estimate from the non-partisan fiscal bureau. Governor Walker’s initial statement about the bonding plan indicated that “there is absolute security for the tax-payers, no new taxes, no drawing on existing revenues, no exposure for the future.” What is essentially problematical is the uncertainty of what happens if NBA salaries do not climb to the level where enough new money pours into the state general fund to pay off the $220 million in arena bonds. Governor Walker’s office provided some excel crunching:

Neil deMause analyzed the number crunching in an article entitled, “Wisconsin governor’s arena plan depends on future NBA players averaging $33m/year salaries:”

That red block along the bottom is how much the Bucks (and visiting teams’ players, pro-rated for the days they play in Milwaukee) pay now in state income taxes, which is $6.52 million a year. The current Bucks player payroll is $62.6 million, and the top state income tax rate is 7.65%, so about two-thirds of that figure comes from the team’s roster, with the rest presumably coming from visiting players, team execs, hot dog sales people, and the like.

How much would salaries have to rise to make the green part of the above chart come true? Walker’s projected state revenue in the year 2046 is about $45 million, meaning at a 7.65% state income tax rate, we’re looking at $588 million in payroll. If two-thirds of that is the Bucks, then for a 12-player roster, the average player salary would have to be $33 million a year in order to make these numbers work.

Is that as crazy as it sounds? The average NBA player salary 31 years ago was $330,000, and it’s $4.1 million today, so it’s on pace with historic trends. (Salaries have leveled off the last few years, but they’re expected to take a big jump in the next CBA thanks to the league’s lavish new TV deal.) But past performance doesn’t guarantee future returns, and lots of things could torpedo that assumption:

- The cable bubble could burst. In fact, it’s a near-certainty that nobody will be watching NBA games in 2046 by turning on a cable box — broadband Internet will have replaced it decades before then — but the issue isn’t really what pipe people use to get their sports fix but how much they’re willing to pay for it. Right now, sports on TV is a loss leader for cable companies to get viewers to buy their service at all; once everybody is watching TV on the web and companies don’t have to worry about cable cutters (because everybody has to have Internet service whether they want to watch TV on it or not), the economic calculations start to change. Unless you envision a future where a huge number of people happily pay $1000 a month for the right to watch sports on TV, NBA revenue — and salary — inflation is going to have to level off sometime soon.

- Basketball could sink in popularity. The NBA has done great at expanding its marketing in recent decades, but who knows what the future holds? Competition from leagues in other nations? Kids defecting to watching e-sports? Not that this necessarily would mean plummeting salaries — baseball has lost market share for a while now, but continues to rake in more cash — but it wouldn’t help.[4]

Governor Walker’s most recent budget proposal included $2.8 million in state funds to cover the first year of debt payments, ie – the $2.8 million is for the state’s fiscal 2016-2017 year that starts on July 1, 2016.

The Report answers some interesting questions:[5]

- What would be the state’s commitment relative to a new arena and what are Appropriation Bonds?

AB 21/SB 21 would authorize the Department of Administration (DOA) to issue $220,000,000 in GPR-supported, state appropriation bonds to make a grant to assist a sports and entertainment district (“district”) in the construction of sports and entertainment facilities used principally for professional basketball, including the acquisition or lease of property. The bills would also provide a net amount of $2,800,000 GPR in 2016-17 from a newly-created, annual debt service appropriation to reflect an estimate of the initial debt service payment on the bonds. Appropriation bonds are not considered public debt of the state and thus are not subject to the state’s constitutional debt limit or any limitations relating to the issuance of public debt. The state would not be legally obligated to appropriate the amounts for payment of debt service on the bonds, and if it does not do so, it would incur no liability to the owners of the bonds. The payment of the bonds would be at the discretion of the Legislature.

- Are there any new taxes included in the proposal, such as the so called “jock tax?”

No. The proposal would not create a new tax. All income taxes including taxes on professional athletes who perform in Wisconsin are deposited into the state’s general fund.

- How are the taxes on NBA personnel related to the proposed $220 million financing?

Under AB 21/SB 21, the state would issue $220 million in appropriation bonds to fund a grant to the District for the construction of an arena facility in Milwaukee. The bonds would be repaid from an annual, GPR appropriation created under the bills. The Governor’s, and the Department of Administration (DOA) Secretary’s, public comments indicate that the $220 million would effectively be repaid from the growth in state personal income taxes associated with projected annual increases in incomes of the players and other personnel of the Milwaukee Bucks organization and of visiting NBA franchises playing at the proposed facility.

The bills would not statutorily tie any income tax revenue to the repayment of the $220 million in bonds. These income tax revenues would be deposited to the state’s general fund. However, as described by the administration, these annual tax amounts would notionally be used to cover the GPR debt service due on the $220 million in bonds. Regardless, interest and principal on the bonds would have to be paid from the general fund no matter what amount of income taxes are collected from NBA players and other employees.

- What is the administration’s policy and reasoning behind the proposed financing method?

The income tax revenues associated with any growth in NBA-related personnel incomes would be deposited to the general fund. The administration argues that those personnel would no longer be earning income in the state if an arena facility is not constructed. They add that if a new arena is not constructed, the NBA has indicated that it would possibly buy back the franchise and possibly look for another host city. Further, the officials note that the amortization schedule on the bonds would be structured so that just the income taxes on the expected growth in incomes of NBA-related personnel in 2014 and beyond would be used to repay the bonds. Conversely, they note that an estimated $6.5 million in existing income tax revenues associated with NBA-related incomes in 2013 would not be used in determining the bond repayment structure and would remain available to the general fund.

- What is the potential state fiscal effect of the proposal?

The Department of Revenue (DOR) has completed a projection of NBA-related personnel salaries over the proposed 30-year period of the arena financing, as well as the growth in state income tax revenues associated with those personnel over that period, assuming current tax rates would remain in place. Attachment 1 provides an illustration of what a potential appropriation bond repayment structure could look like if the $220 million in bond principal were to be repaid in a way that the annual debt service equals the growth in income tax revenues from NBA-related salaries projected by DOR. The repayment structure outlined in Attachment 1 assumes the principal borrowed would be amortized over a 30-year period. The schedule also assumes the bonds could be issued on a federally tax-exempt basis, at a rate of 4.0%.

As indicated in the bonding scenario outlined in Attachment 1, the income tax revenues associated with the projected growth in the incomes of NBA-related personnel would not be sufficient to begin to pay principal on the bonds until 2028-29. As a result, the terms of the bonds would have to allow for what is termed a negative amortization schedule, which results from deferred interest on the bonds. That is, the bond indentures would have to include a repayment structure that would allow for scheduled payments to be made that are less than the interest due on the outstanding principal on the bonds. This unpaid interest is referred to as deferred interest and is added to the outstanding principal balance of the bonds each year.

The bonding scenario outlined in Attachment 1 demonstrates that, due to the negative amortization associated with the deferred interest, the total interest costs associated with financing the $220 million would be $268.4 million, including $53.1 million in deferred interest. As a result, under this scenario, the total fiscal effect to the state associated with financing a $220 million grant would be an estimated $488.4 million. The administration’s policy decision to structure the proposed bond issue so that the amount of debt service due each year on the bonds would be notionally tied to, or mirror, the additional income taxes results in an amortization schedule that cannot meet the interest due on the bonds in the early years of the transaction and back-end loads the repayment of principal to the later years of the transaction. This results in the bonding transaction having higher overall costs than if the amortization schedule had more uniform annual debt service payments.

The Report also addresses the bond transactions being structured differently which includes level payments of $12.7 million over thirty (30) years which would cost almost nearly $107 million less and a twenty (20) year repayment plan that costs $16.2 million a year, but ultimately saves $107 million over Governor Walker’s proposal.

The Report also addresses a myriad of other questions including:

- Can the $220 million in bonds be issued on a federally tax-exempt basis?

- Has the arena facility been designed and what will the facility cost?

- Will the District be responsible for constructing, or contracting for the construction of, the arena facility?

- What happens if a new arena facility is not built?

- Who would maintain and operate the arena facility?

- What revenues would the District have available to properly maintain and operate the arena facility and would those revenues be sufficient?

- Will the lease agreement with the Milwaukee Bucks require the team to cover any of the annual costs of operating and maintaining the new arena as an NBA facility?

- Does the state creating the District in statute leave the state open to any future obligation toward maintaining or improving the new arena facility?

- What will happen to the existing Bradley Center facility?

- How does the proposed $220 million contribution to a professional basketball arena facility in Milwaukee compare to state contributions to other professional sports facilities in the state?

- How does the amount of District tax revenue for the construction, operation, and maintenance of the proposed arena facility compare to the stadium district taxes used to fund those same activities at Miller Park and Lambeau Field?

The Report indicates that there are a myriad of issues that need to be discussed to come to some final conclusions as to how the financing is to ultimately be constructed. Those issues may not be able to be finally resolved by the time the budget is voted upon by the state legislature in May or June of 2015.

The Report clearly indicates that Governor Walker’s plan relies on kicking back future income taxes from NBA players’ salary. “NBA players’ salaries aren’t expected to soar into the necessary stratosphere for a while and therefore the state would probably have to backload payments which would increase the cost of the bonds beyond $220 million.”

In the Report, the Legislative Fiscal Bureau raised the question of whether this method of repaying bonds would open the door to other requests statewide. “Some have raised a concern that the proposed financing may set a precedent at the state level in that other businesses wishing to improve their facilities or operations may ask the state to subsidize their infrastructure needs using the income tax revenues from their employees to pay for the cost of those improvements in exchange for them either retaining or expanding their operations in the state.” [6]

“Therefore, general fund tax revenues, other than those associated with the projected growth in the incomes of NBA-related personnel, would be needed for the debt service on the bonds for the first 14 years of the transaction …,” the Report stated.[7]

The Report states that “if the actual income tax revenues are less than the scheduled debt service, other general fund revenues would have to make up the difference. Further, any legislation that would reduce the state’s personal income tax rates would also result in less income tax revenue from the growth in NBA-related salaries. This would also result in other general fund revenues being needed to make the annual debt-service payments on the bonds.”[8]

The Report further indicates that the growth of incomes of NBA related personnel would be insufficient for the state to begin paying the principal on the bonds until 2028-2029. That would leave the state in a position of having to negotiate bond terms for what is termed a negative amortization schedule, resulting in deferred interest on the bonds, the fiscal bureau said. The unpaid interest in the early years would be added to the outstanding principal balance on the bond debt each year, the Report states.[9]

The Report may result in lessening the amount of financing for the project or finding alternative ways to finance the project.

Shortly after the Report, Republican Senate Majority Leader Scott Fitzgerald announced a plan to contribute around $150 million for a new arena that could come from the State Public Lands Board.

On April 16, 2015, a new Marquette Law School poll was released indicating:

Seventy-nine percent of registered voters oppose a plan being discussed by Republican legislative leaders for the state to cover part of the $250 million in public funding the Milwaukee Bucks owners say they need to complete funding of the estimated $500 million project, the poll found.

Only 17 percent of Wisconsin voters support the $150 million state-area-funding proposal.

Within the Milwaukee metro area, the percentage of voters opposed to state funding is smaller at 67 percent, compared with 88 percent opposed out-state. In the Milwaukee area, 29 percent of voters support state funding but outside metro Milwaukee only 9 percent support the state borrowing for an arena in Milwaukee.[10]

The Metropolitan Milwaukee Association of Commerce (“MMAC”) issued a poll as undertaken by Tarrance Group of Alexandria, Virginia which is in stark contrast to the Marquette Law School Poll released April 16, 2014 that found that 79% of voters opposed the state borrowing $150 million for the proposed arena project. The MMAC poll found that 67% of voters support building a new arena when presented with “a full proposal” and that 64% of all voters agree with Wisconsin borrowing $150 million to help fund the arena. [11]

Certainly this is not the end of the story and it will be interesting over the next several months to see how finally the equation for public and private funding is resolved.

[1] Walker, Don, Journal Sentinel, “Walker proposes investment of $220 million for Bucks arena,” January 27, 2015,

[2] Id.

[3] Imbert, Fred, CNBC, “Wisconsin May Have Found a New Way to Fund Arenas,” January 30, 2015, http://www.cnbc.com/id/102376651

[4] deMause, Neil, “Wisconsin Governor’s Arena Plan Depends on Future NBA Players Averaging $33M/Year Salaries,” Field of Schemes, January 28, 215, http://www.fieldofschemes.com/2015/01/28/8430/wisconsin-governors-arena-plan-depends-on-future-nba-players-averaging-33myear-salaries/

[5] Legislative Fiscal Bureau Memorandum dated March 24, 2015 to the Joint Committee on Finance, http://legis.wisconsin.gov/lfb/publications/Miscellaneous/Documents/2015_03_24%20Sports%20and%20Entertainment%20District%20and%20Arena.pdf

[6] Walker, Don, “Report: Arena Bond Costs Could Be as High as $488 Million,” Journal Sentinel, March 24, 2015, http://www.jsonline.com/news/milwaukee/report-arena-bond-costs-could-be-as-high-as-488-million-b99468487z1-297434821.html

[7] Id.

[8] Id.

[9] Kirchen, Rich, “Cost for Gov. Scott Walker’s Arena-Bond Plan Balloons to $488 Million,” Milwaukee Business Journal, March 24, 2015, http://www.bizjournals.com/milwaukee/morning_roundup/2015/03/cost-for-gov-scott-walkers-arena-bond-plan.html?ana=e_mil_rdup&s=newsletter&ed=2015-03-25&u=lVKEnM6GdoSI%252Foc%252Fom4azuZQw9x&t=1427288260&r=full

[10] Kirchen, Rich, “Overwhelming Thumbs-down From Voters on $150M in State Funding for Downtown Arena: MU Poll,” Milwaukee Business Journal, April 16, 2015, http://www.bizjournals.com/milwaukee/news/2015/04/16/overwhelming-thumbs-down-from-voters-on-150m-in.html?ana=e_du_pub&s=article_du&ed=2015-04-16&u=lVKEnM6GdoSI%252Foc%252Fom4azuZQw9x&t=1429223030&r=full

[11] Kirchen, Rich, “MMAC Poll Says 67% of Voters Support Bucks Arena Funding,” Milwaukee Business Journal, April 27, 2015, http://www.bizjournals.com/milwaukee/news/2015/04/27/mmac-poll-says-67-of-voters-support-bucks-arena.html