Building Green Card Sports Stadiums

By Martin J. Greenberg and Evan R. Fingert

I.  Introduction

Introduction

Congress created the Immigration Act of 1990 (IMMACT90) in November of 1990 which restructured the whole U.S. immigration system, and established the Employment Based Fifth Preference[1] (EB-5) program in the hope that having foreign nationals invest money in commercial enterprises to stimulate economic activity and help job growth in the United States.[2]

EB-5 was established to stimulate the U.S. economy by offering foreign entrepreneurs the opportunity to obtain permanent residency and work in the United States after they had invested in the U.S. economy.[3] For making these investments, foreign entrepreneurs were able to obtain two-year conditional permanent residency visas to come into the United States.[4] After the two year conditional period, if the investment made by the foreign investor met the goals set out by EB-5 program, the foreign investor would have the visa converted into a green card that provided permanent residency in the United States.[5] In obtaining permanent residency, the foreign investor’s family also becomes eligible for immigration into the United States.[6] After five years of holding a green card, the investor and, ultimately, his family are eligible to become citizens of the United States.[7]

When the EB-5 program did not produce much foreign investment during the first few years in existence, Congress created the “Immigrant Investor Pilot Program” in 1993 to help increase interest in the EB-5 visa program.[8] This program created the EB-5 Regional Centers, which are a service agent organization for the foreign investor looking to complete a project under EB-5.[9] These Regional Centers pool investors’ money together and allow the counting of jobs that are indirect jobs.[10] Indirect jobs are jobs that are not directly related to the project for the investment, but are created within businesses that supply goods and services to the EB-5 project.[11] Today, around ninety-five percent of all EB-5 visas come from the Regional Center program.[12]

When the EB-5 program did not produce much foreign investment during the first few years in existence, Congress created the “Immigrant Investor Pilot Program” in 1993 to help increase interest in the EB-5 visa program.[8] This program created the EB-5 Regional Centers, which are a service agent organization for the foreign investor looking to complete a project under EB-5.[9] These Regional Centers pool investors’ money together and allow the counting of jobs that are indirect jobs.[10] Indirect jobs are jobs that are not directly related to the project for the investment, but are created within businesses that supply goods and services to the EB-5 project.[11] Today, around ninety-five percent of all EB-5 visas come from the Regional Center program.[12]

In the late 1990’s, major overhauls to the program were undertaken after cases of fraud were discovered, including, the seminal fraud case, U.S. v. O’Connor.[13] This case involved the defrauding of foreign nationals interested in EB-5 application.[14] The defendants recruited foreign investors to apply for admission into the United State through EB-5, and falsified EB-5 visa applications on behalf of investors.[15] None of the investors invested the required $500,000.[16] The defendants would obtain $100,000 to $150,000 from the foreign investors and put it in an account.[17] The defendants would then place the remaining amount into the same account needed to bring the total to $500,000, thereby making it appear the investment satisfied the EB-5 requirement.[18] The defendants would only keep the money in the account for a short period of time.[19] The defendants falsified W-4 forms and documents to make the whole scheme look legitimate.[20] In the end the defendants stole $21,000,000 from the foreign investors.[21] None of the money was used to create the 10 required jobs.[22] This one case led to the suspending of adjudications of EB-5 Regional Center Cases from the late 90’s to the mid-2000s.[23] There were changes to EB-5 as a result of the fraud discovered in the aforereferenced cases, including: (1) the requirement that investors provide proof that EB-5 investments originated from lawful sources; (2) that the investors are personally involved with their EB-5 project; and (3) a prohibition on the investments returns being guaranteed.[24] Initially the government attempted to apply these changes retroactively, but the courts concluded this action was illegal.[25] With the new rules in place the number of EB-5 applications dropped.[26] What constitutes fraud in EB-5 is deception with intent to obtain financial or personal gain, and by lying to the EB-5 program to be able to obtain investments from foreign investors.[27]

In 2003, Congress passed the Basic Pilot Program Extension and Expansion Act of 2003 to help try to revitalize the EB-5 program.[28] The Act required the Government Accounting Office (GAO) to conduct thorough investigations into the EB-5 visa program.[29] This investigation found that out of the 10,000 visa’s allocated to the EB-5 program only a small number were being used.[30] This led to the reforms of the EB-5 program that made the program what it is today. When this program started the investment stream was very low but that has recently changed.[31] In 2014 and 2015, the Government had to stop accepting applications for EB-5 investments because they had hit their quota for allocated EB-5 visas.[32]

In 2003, Congress passed the Basic Pilot Program Extension and Expansion Act of 2003 to help try to revitalize the EB-5 program.[28] The Act required the Government Accounting Office (GAO) to conduct thorough investigations into the EB-5 visa program.[29] This investigation found that out of the 10,000 visa’s allocated to the EB-5 program only a small number were being used.[30] This led to the reforms of the EB-5 program that made the program what it is today. When this program started the investment stream was very low but that has recently changed.[31] In 2014 and 2015, the Government had to stop accepting applications for EB-5 investments because they had hit their quota for allocated EB-5 visas.[32]

The EB-5 program is a high risk investment and there is no guarantee the foreign investor would make a profit or even get their initial investment back. The main reason foreigners make these investments is that it is a faster way to get a Green Card to come to the United States.[33] Entrepreneurs, who are attempting to get foreigners to make EB-5 investments with their company, say that the “main draw to this is the Green Card.”[34]

A cap of 10,000 visas per year equates to approximately 3,500 investors because the foreign investors’ families are allowed to come to the US with the investor and count towards the visa cap.[35] Foreign investors using EB-5 have mostly come from China with over 9,100 visas issed to Chinese nationals.[36] Other countries foreign investors are starting to part-take in EB-5.[37] These other countries include South Korea who had 162 visas in 2014, Vietnam with 92 visas, and Iran with 72 visas.[38] However, these numbers are different when including the investors’ families.[39] With the families included the numbers increase to 225 visas for South Korea, 121 visas for Vietnam, and 76 visas for Iran.[40]

A cap of 10,000 visas per year equates to approximately 3,500 investors because the foreign investors’ families are allowed to come to the US with the investor and count towards the visa cap.[35] Foreign investors using EB-5 have mostly come from China with over 9,100 visas issed to Chinese nationals.[36] Other countries foreign investors are starting to part-take in EB-5.[37] These other countries include South Korea who had 162 visas in 2014, Vietnam with 92 visas, and Iran with 72 visas.[38] However, these numbers are different when including the investors’ families.[39] With the families included the numbers increase to 225 visas for South Korea, 121 visas for Vietnam, and 76 visas for Iran.[40]

II. EB-5 Program Today

Eligibility for the EB-5 visa program is based on three main elements: (1) the immigrant’s investment of capital, (2) in a new commercial enterprise (“means any for profit activity formed for the ongoing conduct of lawful business”), and (3) that it creates jobs.[41]

Today the EB-5 Program is based on the expectation that the U.S. economy would benefit from the capital contribution by the immigrants.[42] Also, that the benefit to the U.S. economy is greatest when capital is placed at risk and invested into a new commercial enterprise and that the investment results in at least ten jobs for U.S. workers.[43] In the EB-5 Program “capital” is defined as

Today the EB-5 Program is based on the expectation that the U.S. economy would benefit from the capital contribution by the immigrants.[42] Also, that the benefit to the U.S. economy is greatest when capital is placed at risk and invested into a new commercial enterprise and that the investment results in at least ten jobs for U.S. workers.[43] In the EB-5 Program “capital” is defined as

cash, equipment, inventory, other tangible property, cash equivalents, and indebtedness secured by assets owned by the alien entrepreneur [immigrant investor], provided that the alien entrepreneur [immigrant investor] is personally and primarily liable and that the assets of the new commercial enterprise upon which the petition is based are not used to secure any of the indebtedness. All capital shall be valued at fair market value in United States dollars.[44]

The EB-5 Program also defines “invest” as:

[t]o contribute capital. A contribution of capital in exchange for a note, bond, convertible debt, obligation, or any other debt arrangement between the alien entrepreneur and the new commercial enterprise.[45]

EB-5 regulations also require that the foreign investors’ investment must be “at risk” for the purpose of generating a return.[46] Though EB-5 does not specify what degree of risk the investment has to have, the entire amount has to only be at some degree of risk.[47] What “at risk” means is that the investment is not guaranteed to be returned, and therefore a risk of loss and a chance for gain are at hand in the transaction.[48]

The amount of capital that must be invested is at least $1,000,000 in capital in a new commercial enterprise that creates at least ten jobs for U.S. workers.[49] But, the amount can be reduced to $500,000 if the investment is in a “targeted employment area (TEA).”[50]A TEA is an area of high unemployment experiencing at least 150% of the national average unemployment rate or the investment is in a rural area.[51] A rural area is defined as any area outside a metropolitan statistical areas or outside the boundary of any city or town having a population of 20,000 or more.[52] These TEA are loosely defined by each state and states differ on what is a TEA.[53]

The second element of the EB-5 Program is the “New Commercial Enterprise.”[54] What the EB-5 program means by New Commercial Enterprise is any for-profit activity for the conduct of business for any kind of business form.[55] The “New” part of the Commercial Enterprise means one of two things: (1) any commercial enterprise that was established after EB-5 was enacted; or any commercial enterprise that was established before the EB-5 was enacted if the enterprise will be restructured or expanded through EB-5.[56] Commercial Enterprises that were existing enterprise before the enactment of EB-5 are eligible to obtain EB-5 if the business is completely reorganized using EB-5 investment, is a business with current employees that funds an expansion using EB-5 investment, or is a business with current employees that qualifies as a “troubled business.”[57]

The third and final element is the creation and preservation of at least 10 full-time jobs, i.e. – working a minimum of 35 working hours per week, for qualified U.S. workers within two years.[58] If at least 10 full-time jobs are created after two years the visa can be converted into a green card.[59] This element is different if the investment is in a Regional Center.[60] The Regional Center jobs can be either direct jobs which are actual jobs within the EB-5 investor’s investment, or the jobs can be indirect jobs which are collateral jobs resulting from the EB-5 investment in a commercial enterprise affiliated with a Regional Center, such as job opportunities for project subcontractors and materialmen.[61]

III. Process of Obtaining an EB-5 Green Card

The process of obtaining a green card is long.[62] After first selecting a project, the investor has to then wire the money ($500,000 to $1 million) to the Regional Center or to a new commercial enterprise along with the one-time administrative fee.[63] The money must be wired, often to an escrow account, before the investor’s visa application (I-526) is filed.[64] The I-526 petition is a form to prove eligibility for EB-5 Program which must be filed to obtain a visa.[65] The processing time for I-526 petition averages 16.6 months.[66] Once the I-526 petition is approved the investors obtain their visa.[67] If they are denied their investment is refunded.[68] After the I-526 is approved, the investor will each have to file an I-485 petition to adjust their status within the United State to become a conditional permanent resident.[69] If the investor is not in the United States, a DS-230 is utilized for investors and their dependents to commence conditional permanent residency upon entry to the United States.[70] Ninety days before the investor’s two-year anniversary of the approval of the I-526, the investors submit an I-829 form.[71] The I-829 is the form that removes the conditions of permanent residency.[72] Once approved, the investor and dependents receive a ten-year green card that can be renewed indefinitely. The I-829 form processing takes an average of 20.1 months to be approved.[73] This process is complex and lengthy, and could “take seven years or more to be able to obtain permanent citizenship.”[74]

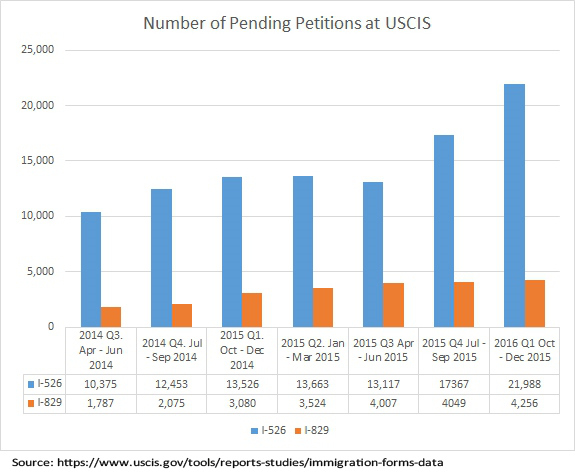

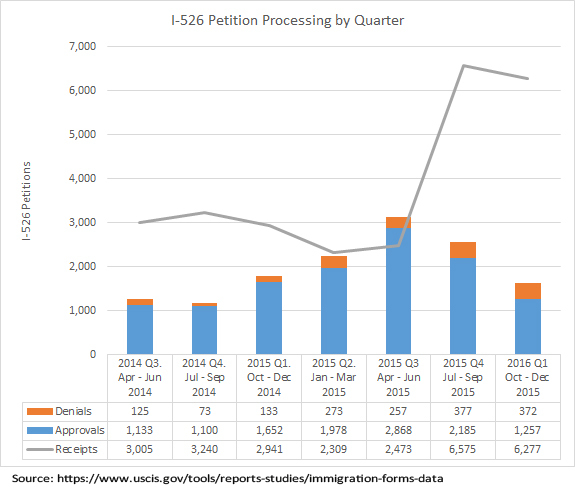

Not everyone who applies will obtain an EB-5 visa. The process is long and cumbersome with a vast number of steps to complete.[75] Wait times for processing the I-526 forms are also long.[76] The total number of petitions that are approved or denied each quarter is less than half of the new petitions filed. Each quarter the number of pending petitions rises.

Not everyone who applies will obtain an EB-5 visa. The process is long and cumbersome with a vast number of steps to complete.[75] Wait times for processing the I-526 forms are also long.[76] The total number of petitions that are approved or denied each quarter is less than half of the new petitions filed. Each quarter the number of pending petitions rises.

On January 19, 2017, Plaintiffs South San Francisco Development Funding, LP and Dongliang Fan, an EB-5 program foreign investor, sued Jeh Johnson, Secretary of the United States Department of Homeland Security, Leon Rodriguez, Director of the United States Citizenship and Immigration Services, Nicholas Colucci, Chief of the Immigrant Investor Program Office of the United States Citizenship and Immigration Services, and the United States Citizenship and Immigration Services (USCIS) in the Southern District of New York of the United States District Court accusing the agencies of delaying a green card application so severely that it is having a negative effect on the business. The Complaint essentially alleges that the USCIS has taken too long to approve Fan’s request to immigrate under the EB-5 Program, and requests an order from the court granting the Plaintiff’s Writ of Mandamus and/or under the APA requiring the defendants to adjudicate investor Plaintiff’s I-526 petition and the other I-526 petitions based on investments into the fund within thirty (30) days.

IV. Where EB-5 Has Been Used

EB-5 real estate projects take on different business models and have included mixed-use retail, hotels, sports stadiums, restaurants, casinos, entertainment venues, convention centers, and office buildings.[77] Under EB-5, $3.7 billion to-date has been invested in major US cities including $600 million for the Hudson Yard project, $250 million for the Hunter Point Shipyard, and $150 million in the Sahara Hotel and Casino.[78] Since 2012, the USCIS says that the EB-5 Program has brought $8.7 billion into the United States economy, and created more than 35,000 jobs.[79] EB-5 has been widely used in real estate.[80]

Recently, EB-5 was used to build the SLS Hotel & Casino in Las Vegas, which was previously known as the Sahara.[81] EB-5 funding was utilized to renovate the current casino and rename the property.[82]

Recently, EB-5 was used to build the SLS Hotel & Casino in Las Vegas, which was previously known as the Sahara.[81] EB-5 funding was utilized to renovate the current casino and rename the property.[82]

EB-5 funding has also been used for 30 Park Place in New York City, which will be a hotel and condominium tower.[83] The price tag for this project is over $20 billion and the developer has obtained $600 million from EB-5 investors from China.[84]

In San Francisco, EB-5 funds are being used for the development of Hunters Point Shipyard.[85] The developers, Lennar Urban, have obtained $250 million from EB-5 investors for the approximate $8 billion project.[86] The project will create more than 12,000 housing units, hundreds of acres of parks, 800,000 square feet of retail and 3.1 million square feet for office and commercial research and development.[87] The development of this project included demolishing Candlestick Park, the old home of the San Francisco 49ers.[88] The hope is to help improve the impoverished neighborhood and lower the homicide rate in the area.[89]

Other large projects that have been in part funded by EB-5 investments include:

Pacific Park (Atlantic Yards, Brooklyn, NY) – Mixed-use project including the Barclay’s Center and transit infrastructure raised over $577 million in EB-5 funding.[90]

Pacific Park (Atlantic Yards, Brooklyn, NY) – Mixed-use project including the Barclay’s Center and transit infrastructure raised over $577 million in EB-5 funding.[90]- Four Seasons Hotel (Manhattan, NY) – A hotel wherein $250 million in EB-5 funding was raised.[91]

- 701 7th (Manhattan, NY) – Mixed-use project with a hotel and retail space, over $200 million in EB-5 funding was raised.[92]

- City Point Brooklyn (Brooklyn, NY) – Affordable housing units and retail spaces, over $200 million in EB-5 funding was raised.[93]

- One Park Lane (Brooklyn, NY) – Condominiums wherein over $200 million in EB-5 funding was raised.[94]

- Steiner Studios (Brooklyn, NY) – Largest US Film and Television studio outside of Hollywood, over $195 million in EB-5 funding was raised.[95]

- 625 W. 57th Street (Manhattan, NY) – A residential tower where over $180 million in EB-5 funding was raised.[96]

- 101 Tribeca Avenue (Manhattan, NY) – Residential skyscraper wherein over $175 million in EB-5 funding was raised.[97]

- Panorama Tower (Miami, FL) – An apartment building tower where $50 million in EB-5 funding was raised.[98]

V. Problems

V. Problems

There are problems with EB-5 program that have received attention in the news.[99] Many politicians do not like the program because it’s a way for wealthy people to be able to jump the line for a green card without going through the usual methods.[100]

Several EB-5 projects have been the subject of federal investigations involving narcotics trafficking, money laundering, fraud, espionage, and national security concerns.[101] Programs of this kind are also subject to fraud that results not only in the loss of money but can have an impact on the investor’s green card status.[102] Because EB-5 investments have a high level of risk and many foreign investors make the investment only to obtain a visa, fraud occurs when the recipients of the EB-5 money misuse the money that foreign investors have given them.[103] To be approved, EB-5 projects are required to provide information on how the money will be used.[104] If the funding is used for something else then problems occur.[105] In some cases, however, EB-5 funding was found to have been utilized in paying off debts and personal expenses.[106] Some of the fraud cases have even involved a “Ponzi-like” scheme.[107]

The most notable EB-5 fraud case is the Jay Peak Resort in Vermont.[108] Cases involving EB-5 fraud have occurred all over the country, and the SEC has put EB-5 investigations on the top of their to-do list.[109] The Jay Peak Resort EB-5 fraud case involved two businessmen, Ariel Quiros and Bill Stenger, who misused more than $200 million of about $400 million that was obtained from over 700 investors from around the world through the EB-5 foreign investor program.[110] One of the businessman used some of the EB-5 money for his own personal use, including buying the Jay Peak and Burke Mountain ski resorts, a luxury condo in Trump Place in New York, pay off loans, and to pay income taxes, which resulted in lawsuits and a court appointed receiver.[111] In October of 2016 it was reported that a federal judged had approved a $13.3 million dollar settlement with Citibank.[112] Subsequently in April of 2017, Raymond James agreed to a $150 million dollars settlement with the court appointed receiver.[113] Fraud and other misdeeds in the program are commonplace and USAdvisors.org maintains the eb5projects.com website that includes a database and list of EB-5 litigation.[114]

The most notable EB-5 fraud case is the Jay Peak Resort in Vermont.[108] Cases involving EB-5 fraud have occurred all over the country, and the SEC has put EB-5 investigations on the top of their to-do list.[109] The Jay Peak Resort EB-5 fraud case involved two businessmen, Ariel Quiros and Bill Stenger, who misused more than $200 million of about $400 million that was obtained from over 700 investors from around the world through the EB-5 foreign investor program.[110] One of the businessman used some of the EB-5 money for his own personal use, including buying the Jay Peak and Burke Mountain ski resorts, a luxury condo in Trump Place in New York, pay off loans, and to pay income taxes, which resulted in lawsuits and a court appointed receiver.[111] In October of 2016 it was reported that a federal judged had approved a $13.3 million dollar settlement with Citibank.[112] Subsequently in April of 2017, Raymond James agreed to a $150 million dollars settlement with the court appointed receiver.[113] Fraud and other misdeeds in the program are commonplace and USAdvisors.org maintains the eb5projects.com website that includes a database and list of EB-5 litigation.[114]

The United States Securities and Exchange Commission (SEC) has issued an alert concerning EB-5 investment scams. The SEC has urged foreign investors to be cautious of fraudulent investment opportunities. The SEC alert outlines the warning signs of EB-5 Investment Fraud:

Promises of a guaranteed Visa or permanent residency

Guaranteed investment returns/Promises of no Investment Risk

Overly consistent high investment returns

Investments that are not registered as regional centers

Unlicensed sellers (Designation as a regional center does not make a seller licensed)

Layers of companies run by the same individuals[115]

In EB-5 fraud cases, the main concern for the foreign investors is their visa status.[116] If the money they invested was not used properly, they may be deported back to their country of origin.[117] Most of the foreign investors care about the money they invested, but are more concerned with their immigration status.[118]

Another problem with the EB-5 Program is the concern that foreign investors are using the program as a way to get out of their homeland after committing serious crimes and for terrorists to gain entry into the United States.[119]

Another problem with the EB-5 Program is the concern that foreign investors are using the program as a way to get out of their homeland after committing serious crimes and for terrorists to gain entry into the United States.[119]

To date the EB-5 program accounts for 1% of the new permanent immigrants in the United State annually.[120] It has been estimated that the EB-5 program has resulted in more than $13 billion investments by EB-5 investors, and has created 12,000 to 41,000 jobs for U.S. workers per year depending on the estimates used.[121]

VI. Public Stadium Financing

Public financing is difficult to obtain, and difficult to sell to communities around the United States.[122] Any form of alternative funding that does not involve a tax, and that is privately generated, is always welcomed in the field of sports facility development.[123] Jake Simpson of The Daily Dose, in an article from 2014 entitled Wealthy Immigrants Could be Funding the Next U.S. Sports Arenas, states as follows:

Sports owners, developers and regional politicians are increasingly keen to use so-called EB-5 financing to fund a portion of stadium and arena construction projects across the U.S. And the lawyers and financiers who work with EB-5 investors say the rapid growth of the program — and a crescendoing public outcry against financing stadium construction with new taxes — makes its near-term entrance into the sports world inevitable.

“It’s a great source of capital,” said Gregory Steinhauer, president of real estate developer American Life. “It’s one of the few programs that doesn’t cost the U.S. government one penny, and it serves as a huge catalyst of investments for projects that otherwise wouldn’t happen.”

Even die-hard pro sports fans are tired of the seemingly endless parade of new stadiums, ballparks and arenas funded by bilking the citizenry. Many new complexes for American pro sports franchises are partially financed by taxes on local municipalities or counties, an unpopular practice that some refer to as sports welfare.

EB-5 financing provides a palatable alternative for projects that need a shot of capital to get off the ground.[124]

The use of EB-5 has been discussed with respect to funding a new stadium for MLB’s Tampa Bay Rays and a new Major League Soccer (MLS) stadium in Las Vegas.[125]

The use of EB-5 has been discussed with respect to funding a new stadium for MLB’s Tampa Bay Rays and a new Major League Soccer (MLS) stadium in Las Vegas.[125]

VII. Orlando City FC Stadium

The Orlando City FC (Orlando City) is building a soccer stadium in the City of Orlando just two blocks from the Amway Center, home of the NBA Orlando Magic.[126] The stadium will be financed 100% with private money.[127] Orlando City bought the 12.5 acres of land from the City of Orlando for $22 million,[128] and the team will have total control of the land for the building of the stadium.[129] The soccer stadium is designed with the intention of creating one of the loudest and most intimidating atmospheres in Major League Soccer.[130] The stadium will have the only safe standing supporter section in North America with a low slanted roofline to amplify crowd noise and protect the fans from the elements of Mother Nature.[131] The new Orlando City Stadium is comprised of 433,000 square feet with 2,871 club seats.[132] Populous and C.T. Hsu & Associates served as architects, Barton Malow as general contractor, Walter P. Moore as structural engineer, and Icon Venue Group as owner’s representative.[133]

Initially the stadium was to be built with public and private money and was planned to seat about 19,000, but on May 29, 2015 the owners of the team announced it would be 100% privately funded and will have a capacity of about 25,500 people.[134] The capacity can expand due to the fan plaza spanning 10,000 square feet.[135] The playing field will be sunken 8 feet below ground level so the fans can have spectacular views from street level, and will be natural grass.[136]

The inspiration for the stadium came from sports venues all around the world including other MLS stadiums.[137] The team does not plan to build parking garages as there are already sufficient parking options around the new stadium.[138] Orlando City President Phil Rawlins hopes that attendees use the public transportation to get to the games.[139] The cost of the stadium is now projected to be at $156 million.[140]

The inspiration for the stadium came from sports venues all around the world including other MLS stadiums.[137] The team does not plan to build parking garages as there are already sufficient parking options around the new stadium.[138] Orlando City President Phil Rawlins hopes that attendees use the public transportation to get to the games.[139] The cost of the stadium is now projected to be at $156 million.[140]

The financing plan is to obtain half of the $156 million for stadium construction costs through the EB-5 program.[141] If each foreign investor invests the minimum $500,000, there would need to be 156 investors.[142] As of May 2016, the team had obtained 30 investors, or approximately $15 million of EB-5 funding.[143]

However, a recent feature by Don Muret (Muret) in the March 13, 2017 Sports Business Journal entitled “Roar of Orlando,” indicated in a column “A small world after all: How visa program helped pay bills” indicating that 20% of the Orlando City Stadium would utilize EB-5 funding.[144] Muret further indicated that the club had now generated nearly 30 million dollars through the EB-5 Visa Program.[145] Orlando is one of the first MLS franchises to win “project finance.”[146] “Goldman Sachs last year lent $145 million to LAFC for its new stadium, scheduled to open next year, as well as $35 million to the club.”[147] Orlando Mayor, Buddy Dyer, said that the team’s solution “ended up being a win-win for everybody.”[148] Dyer said, “[w]hat I tell other mayors is that I’m the happiest mayor in America, and I go through the whole litany, including soccer.”[149]

VIII. EB-5 Stadium Financing

Until recently, EB-5 has never specifically been used for building sports stadiums, though EB-5 has been used for real estate and infrastructure.[150] EB-5 has been used in the infrastructure around the Barclays Center in Brooklyn, New York, home of the NBA Brooklyn Nets and NHL New York Islanders, to help build around the arena and improve the location.[151] Additionally, EB-5 has been used in the infrastructure around the Staple Center in Los Angeles, California. EB-5 was used in Los Angeles for the building of the hotels,[152] and surrounding projects at the site of LA Live, such as restaurants and night life.[153] Developers of sports facilities have looked at EB-5 program before, but have not used them because of the slow pace of getting EB-5 investors approved for the projects that have specific timelines for the facility to open.[154]

For the first time ever the Orlando City owner, Flavio Augusts da Silva (da Silva), is trying to raise money through the EB-5 program to help build the soccer stadium for the team.[155] The owner of Orlando City, da Silva, got his own green card by investing in an EB-5 program in Vermont investment in 2009.[156] Da Silva made a fortune.[157] His net worth was $444 million in 2014 according to Forbes Brazil, building a chain of English Language Schools in his native Brazil, and decided to signal out his countrymen as far as obtaining investment under EB-5 for the stadium.[158] Brazilians are soccer-mad and some even follow Orlando City, who’s games are broadcast in Brazil and who are led by Kaka, a World Cup winner for Brazil and a former World Player of the Year.[159]

For the first time ever the Orlando City owner, Flavio Augusts da Silva (da Silva), is trying to raise money through the EB-5 program to help build the soccer stadium for the team.[155] The owner of Orlando City, da Silva, got his own green card by investing in an EB-5 program in Vermont investment in 2009.[156] Da Silva made a fortune.[157] His net worth was $444 million in 2014 according to Forbes Brazil, building a chain of English Language Schools in his native Brazil, and decided to signal out his countrymen as far as obtaining investment under EB-5 for the stadium.[158] Brazilians are soccer-mad and some even follow Orlando City, who’s games are broadcast in Brazil and who are led by Kaka, a World Cup winner for Brazil and a former World Player of the Year.[159]

MLS does not permit EB-5 type of financing for the purchase of clubs, but MLS thought it was appropriate for building the stadium.[160] Mark Abbott, Commissioner of MLS, said the league had received the financing proposal and found it innovative.[161] “The league doesn’t permit this type of financing for clubs,” Abbott said, “but for stadium projects, we thought it was appropriate.”[162]

Da Silva is trying to obtain investors from his home country of Brazil to invest.[163] In return for their EB-5 investment with da Silva, the investor will not only obtain a green card, but they will also get annual dividends and two club level season tickets for ten years.[164]

Da Silva is trying to obtain investors from his home country of Brazil to invest.[163] In return for their EB-5 investment with da Silva, the investor will not only obtain a green card, but they will also get annual dividends and two club level season tickets for ten years.[164]

The reason why Orlando City is using the EB-5 Program is that the stadium was originally going to be built with subsidized money from the city and county, but the state rejected the sales tax rebate.[165] With the legislative session ending and no time to find a new way to have the stadium publicly funded, Orlando City had to initiate a new plan.[166] Orlando City was under a deadline to have a new stadium opened by 2017 to be able to have an MLS team in Orlando.[167] The team decided to build the stadium out of 100 percent private funds.[168] With da Silva using the EB-5 Program to get his green card, he came up with this way to partially finance the stadium, and make sure their team knew they had a deal for a new stadium in place.[169]

The neighborhood in which the Orlando City stadium is being built is Parramore, [170] one of Orlando’s poorest neighborhoods with an unemployment rate of approximately 23.8 percent.[171] The national unemployment rate is 4.9 percent.[172] This means the EB-5 Program minimum investment is $500,000, instead of $1 million, because Parramore is considered a TEA.[173]

Orlando City stadium is the only stadium that has been built with 100 percent private money since Joe Robbie Stadium opened in 1987.[174] Though both utilized private funding, the financing for the two was different. Joe Robbie was built by Joe Robbie for the Miami Dolphins out of his own money, bank loans of $100 million, and selling club seats with 10-year contracts.[175] For Orlando City, the team owners are investing half of their own money and the other half from EB-5.[176]

With the team using private money instead of public money, the team will now operate the stadium, and will not share the revenues.[177] Private funding also resulted in reducing the non-relocation clause period from 15 years to 10 years.[178] Orlando City does not have to pay rent for the stadium because they are privately financing it.[179] That rental amount per year would have been $675,000.[180] Though the team will have to pay property taxes on the stadium, it is reported that this amount will still be less than the rent per year.[181]

IX. What EB-5 Feels Like

In some way Orlando City reminds us of the Green Bay Packers. The Packers received some of their money by selling certificates of ownership of the team to the public.[182] The Orlando City investment is similar to that of the Green Bay Packers in that foreign investors are investing in the team even though they have no control over what the team does with it, players, or anything else.[183] In both cases the investors usually do not get a return of their investment.[184] In return for the investment in the Packers, investors receive a stock certificate saying they are an owner and can go to the annual shareholder meetings.[185] With the Orlando City investment, foreign investors receive a green card allowing them and their families to live in the United States.[186] With the Packers, you cannot resell the stock to another person. [187]The similarity with both investments is that the investments are made, not for a return, but for other reasons.[188] In one case it’s to say you’re an owner of the Packers, with the other, Orlando City, it is to obtain a green card faster than the usual methods.[189]

X. Conclusion

If Orlando City can do this with EB-5 other new MLS teams may do the same. Recently, MLS has said they will permit privately finance stadiums without public money.[190] This could be a turning point in sports if Orlando City can succeed in using EB-5. The big obstacle may be whether the EB-5 Program is renewed, canceled, or redone.

In 2015 Congress passed a bill to keep the government running through September 30, 2016.[191] Included within that bill was a one- year extension of the EB-5 program, thru year’s end, i.e. – December 31, 2016.[192] The EB-5 program has recently been extended twice by Continuing Resolutions passed by Congress to avoid a Government shutdown.[193] On September 28, 2016 the House and Senate passed a Continuing Resolution and the President signed the bill into law the next day that extended the EB-5 program to December 9, 2016.[194] The Continuing Resolution was a temporary solution that continued funding the government, including the EB-5 program, only through Dec. 9, 2016.[195] On Dec. 9, 2016 President Obama signed another Continuing Resolution that was passed by Congress that extended funding of the Federal Government, including EB-5, through April 28, 2017.[196] Both of these resolutions extended EB-5 without changes.[197] Though there were reports of attempts to make changes to EB-5 in the Continuing Resolution, the resolutions fell through and no changes were adopted.[198] President Obama has left it up to President Trump to determine if the EB-5 Program will continue or be changed. While President Trump is vocal concerning illegal immigration, EB-5 is a legal immigration program.[199] The EB-5 Program should continue under President Trump, as he has used EB-5 in his projects.[200]

Changes to the EB-5 program are being considered by Congress.[201] One change would be to increase the number of visas given out each year to help the backlog of investors.[202] Other proposed changes would increase the minimum investment required to get a visa, having different minimum investments depending on where the project is located, and reserving 20% of the annual available visas for rural areas.[203] While increasing the minimum investment was expected, what was not expected was a provision making the new minimums retroactive.[204]

With what has happened recently with public financing of stadiums, and taxpayers being upset with the use of public money, the EB-5 program could be used more in the future, despite its problems.

The EB-5 program needs to continue as law even if there are changes to the EB-5 program. With the program in the past few years using all available green cards, and having a long waiting list to be able to participate in the program, indications are that investors are willing to invest in the United States economy. If the program is eliminated the loss of investment money coming from outside of the States would have a negative impact. Lots of the construction projects, like the Hudson Yard, would not have raised the money to undertake such projects.

Evan R. Fingert is currently a third-year law student at Marquette University where he is focusing on Sports Law. In addition to being a 2017 Juris Doctor candidate, Fingert is also a 2017 Sports Law Certificate candidate at Marquette through the National Sports Law Institute. Fingert is also focused in the Labor and Employment Law area of Sports Law. Fingert serves as a Staff Member of the Marquette Sports Law Review (Volume 27), is a member of the Sports Law Society at Marquette, and is Co-President of the Jewish Law Student Association. Prior to Marquette, Fingert earned his Bachelor of Arts in Business Administration with a Specialization in Sports Management and a Minor in Entrepreneurship from the University of Florida. During his law school tenure, Fingert has garnered various types of experience, including working for Legal Action of Wisconsin, as a Judicial Intern for Milwaukee County Circuit Court Civil Division, the National Sports Law Institute, and working with Martin J. Greenberg on Stadium Leases.

[1] Scott Maxwell, Want a green card? Then pony up cash. It’s the American way., Orlando Sentinel (May 20, 2016), http://www.orlandosentinel.com/opinion/os-orlando-soccer-visas-scott-maxwell-20160520-column.html.

[2] History of the EB-5 Program, Eb5investors.com, http://www.eb5investors.com/eb5-basics/history-of-eb5 (last visited May 21, 2016).

[3] Id.

[4] What is an EB-5 visa?, Eb5investors.com, http://www.eb5investors.com/eb5-basics/what-is-eb5 (last visited May 21, 2016).

[5] Id.

[6] EB-5 Immigrant Investor Program, U.S. Citizenship and Immigration Services, https://www.uscis.gov/eb-5 (last visited May 23, 2016).

[7] EB-5 step by step, Eb5investors.com, http://www.eb5investors.com/eb5-basics/eb5-steps (last visited May 23, 2016).

[8] History of the EB-5 Program, supra note 2.

[9] Id.

[10] Kate Kalmykov and James Cormie, EB-5 Regional Center, Eb5investors.com, http://www.eb5investors.com/eb5-basics/eb-5-regional-center (last visited May 23, 2016).

[11] EB-5 Job Creation, Eb5investors.com, http://www.eb5investors.com/eb5-basics/us-investor-visa (last visited May 23, 2016).

[12] EB-5 Basics, What is an EB-5 Project?, eb5investors, http://www.eb5investors.com/eb5-basics/what-is-a-project (last visited Oct. 14, 2016).

[13] History of the EB-5 Program supra note 2.

[14] United States v. O’Connor, 158 F.Supp. 2d 697, 705 (E.D. Va. 2001).

[15] Id.

[16] Id.

[17] Id.

[18] Id. at 707.

[19] Id. at 707.

[20] Id. at 709.

[21] Id. at 706.

[22] Id. at 710.

[23] History of the EB-5 Program, supra note 2.

[24] Id.

[25] Id.

[26] Id.

[27] See United States v. O’Connor, 158 F.Supp. 2d 697

[28] History of the EB-5 Program supra note 2.

[29] Id.

[30] Id.

[31] Id.

[32] Sophia Yan, U.S. Runs Out of Investor Visas Again as Chinese Flood Program, CNN Money (April 15, 2015), http://money.cnn.com/2015/04/15/news/economy/china-us-visa-eb5-immigrant-investor/.

[33] Alana Semuels, Should Congress Let Wealthy Foreigners Buy Green Cards?, The Atlantic (Sep. 21, 2015), http://www.theatlantic.com/business/archive/2015/09/should-congress-let-wealthy-foreigners-buy-citizenship/406432/.

[34] Ken Belson, Price for a Green Card: $500,000 Stadium Stake, New York Times (May 16, 2016), http://www.nytimes.com/2016/05/17/sports/soccer/orlando-soccer-stadium-foreign-investors-visas.html?_r=0.4.

[35] Ali Jahangiri, The 19,000-Pound Gorilla in the Room, Huffington Post (Feb. 25, 2016), http://www.huffingtonpost.com/ali-jahangiri/the-19000-pound-gorilla-i_b_9312396.html.

[36] Semuels, supra note 33.

[37] Id.

[38] Shanshan Liu, An Overview of the 2015 EB-5 Statistics: I-526 Petitions and Number of Visas Issued, eb5investors.com (Feb. 9, 2016), http://www.eb5investors.com/blog/overview-2015-eb5-statistics.

[39] Semuels, supra note 33.

[40] Table V (Part 3) Immigrant Visa Issued and Adjustments of Statutes Subject to Numerical Limitations Fiscal Year 2014, https://travel.state.gov/content/dam/visas/Statistics/AnnualReports/FY2014AnnualReport/FY14AnnualReport-TableV-PartIII.pdf (last visited Nov. 15, 2016).

[41] Policy Memorandum, EB-5 Adjudications Policy, U.S. Citizenship and Immigration Services (May 30, 2013) https://www.uscis.gov/sites/default/files/USCIS/Laws/Memoranda/2013/May/EB-5%20Adjudications%20PM%20(Approved%20as%20final%205-30-13).pdf.

[42] Id.

[43] Id.

[44] Id.

[45] Id.

[46] Id.

[47] Id.

[48] Id.

[49] Id.

[50] Id.

[51] EB-5 Basics, EB-5 Visa Requirements, eb5investors, http://www.eb5investors.com/eb5-basics/eb-5-visa-requirements (last visited Oct. 10, 2016).

[52] Id.

[53] Alana Semuels, Should Congress Let Wealthy Foreigners Buy Green Cards?, Theatlantic.com (Sep. 21, 2015), http://www.theatlantic.com/business/archive/2015/09/should-congress-let-wealthy-foreigners-buy-citizenship/406432/.

[54] Policy Memorandum, supra note 41.

[55] Id.

[56] Id.

[57] Lucid Professional Writing, EB-5 Investment in “new” and “Existing” Businesses, WordPress, https://ebfive.files.wordpress.com/2011/07/eb5_option_table7.pdf (last visited Sept. 28, 2016).

[58] Policy Memorandum, supra note 41.

[59] Id.

[60] Id.

[61] Id.

[62] EB-5 Step by Step, Eb5investors, http://www.eb5investors.com/eb5-basics/eb5-steps (last visited Dec. 8, 2016).

[63] Id.

[64] Id.

[65] I-526 Petition, Eb5investors, http://www.eb5investors.com/eb5-forms/i-526-petition (last visited Dec.10, 2016).

[66] Kristen W. Ng, Updates EB-5 Processing Times Released by USCIS, Eb5insights (July 15, 2016), http://www.eb5insights.com/2016/07/15/updated-eb-5-processing-times-released-by-uscis/.

[67] EB-5 Step by Step, supra note 62.

[68] Id.

[69] I-485 Application, Eb5investors, http://www.eb5investors.com/eb5-forms/i-485-application (last visited Dec. 10, 2016).

[70] DS-230 Application, Eb5investors, http://www.eb5investors.com/eb5-forms/ds-230-application (last visited Dec. 10, 2016).

[71] I-829 Petition, Eb5investors, http://www.eb5investors.com/eb5-forms/i-829-petition (last visited Dec. 10, 2016).

[72] Id.

[73] Ng, supra note 66.

[74] Stephen Loiaconi, American citizenship for sale? EB-5 visa program under fire, WJLA.com (May 17, 2016) http://wjla.com/news/nation-world/american-citizenship-for-sale-eb-5-visa-program-under-fire.

[75] EB-5 Step by Step, supra note 62.

[76] Ng, supra note 66.

[77] EB-5 Basics, supra note 12.

[78] Qi Xijia, American foreign investor program remains most popular with wealthy Chinese, GobalTimes.cn (March 13, 2016) http://www.globaltimes.cn/content/973495.shtml.

[79] Ellen Sheng, China’s Favorite U.S. Visa Program May Have Ally in Donald Trump, Forbes (Nov. 30, 2016), http://www.forbes.com/sites/ellensheng/2016/11/30/us-eb-5-visa-program-china-donald-trump/#2519ef9ed644.

[80] Julie Satow, Want a Green Card? Invest in Real Estate, New York Times (May 15,2015), https://www.nytimes.com/2015/05/17/realestate/want-a-green-card-invest-in-real-estate.html?_r=0.

[81] Alexandra Berzon & Kris Hudson, Closed Casino Banks on U.S. Program, The Wall Street Journal (Feb. 12, 2013) http://www.wsj.com/articles/SB10001424127887323511804578300380568358910.

[82] Las Vegas Regional Center, eb5investors.com, http://www.eb5investors.com/directories/regional-centers/las-vegas-regional-center (last visited May 30, 2016).

[83] 30 Park Place, therealdeal.com (July 10, 2014) http://therealdeal.com/2014/07/10/30-park-place/.

[84] Hudson Yards, New York, Bisnow.com, https://www.bisnow.com/national/news/commercial-real-estate/top-eb-5-projects-51067?slideshow#3 (last visited June 3, 2016).

[85] Matt Sheehan, Can Chinese Millionaires Save San Francisco Neighborhood?, Huffington Post (Sep. 18, 2014) http://www.huffingtonpost.com/2014/08/21/eb-5-san-francisco-shipyards_n_5687158.html.

[86] Id.

[87] Id.

[88] Id.

[89] Id.

[90] EB-5 Daily, 12 Biggest Projects In The U.S. Funded By EB-5 Investment, EB-5 Daily (Jan. 14, 2016), http://www.eb5daily.com/eb-5-investment/.

[91] Id.

[92] Id.

[93] Id.

[94] Id.

[95] Id.

[96] Id.

[97] Id.

[98] Id.

[99] Semuels, supra note 53.

[100] Id.

[101] Brian Ross & Matthew Mosk, The $500,000 Green Card: Are Suspected Criminals, Spies and Terrorists Buying Their Way Into American?, ABC News, http://abcnews.go.com/Nightline/fullpage/500000-green-card-eb-visa-program-28662457 (last visited Sept. 18, 2016).

[102] Id.

[103] Ellen Sheng, Foreign Investors Defrauded Through U.S. EB-5 Visa Program, Forbes (Aug. 1, 2016), http://www.forbes.com/sites/ellensheng/2016/08/01/foreign-investors-defrauded-through-u-s-eb-5-visa-program/#55bf16514afe.

[104] Id.

[105] Id.

[106] Id.

[107] Eliot Brown, SEC Alleges ‘Ponzi-Like’ Scheme in Vermont Involving EB-5 Visa Program, The Wall Street Journal (Apr. 14, 2016, 3:28 PM), http://blogs.wsj.com/law/2016/04/14/sec-suit-alleges-massive-ponzi-like-scheme-centered-near-vermont-ski-resort/.

[108] Id.

[109] Id

[110] Lisa, Rathke, Fraud claims surround owner of Vermont’s Jay Peak ski area, Salt Lake Tribune (Apr. 20, 2016), http://www.sltrib.com/home/3799121-155/fraud-claims-surround-vermont-ski-area.

[111] Id.

[112] Keays, Alan J., Federal Judge Oks $13.3M Jay Peak Settlement with Citibank, VTDIGGER.ORG (Oct. 19, 2016), https://vtdigger.org/2016/10/19/federal-judge-oks-13-3m-jay-peak-settlement-citibank/

[113] Keays, Alan J. and Anne Galloway, Updated: Raymond James Agrees to Pay $150 Million in EB-5 Fraud Settlement,, VTDIGGER.ORG (Apr. 13, 2017), https://vtdigger.org/2017/04/13/brokerage-firm-eb-5-fraud-case-agrees-150m-settlement/

[114] Litigation, EB-5 Invetsment, https://eb5projects.com/litigation (last visited Jan. 27, 2017).

[115] EB-5 Investment Fraud, Girard Gibbs LLP, http://www.girardgibbs.com/eb-5-investment-fraud (last visited Jan. 27, 2017).

[116] Id.

[117] Id.

[118] Hilary Niles, Foreign Investors Left in Immigration Limbo as Officials Invesigate EB-5 Fraud, VPR News (May 27, 2016), http://digital.vpr.net/post/foreign-investors-left-immigration-limbo-officials-investigate-eb-5-fraud#stream/0.

[119] Ross & Mosk, supra note 101.

[120] Muzzaffar Chishti and Faye Hipsman, Controversial EB-5 Immigrant Investor Program Faces Possibility of Overhaul, Migration Policy (May 25, 2016), http://www.migrationpolicy.org/article/controversial-eb-5-immigrant-investor-program-faces-possibility-overhaul.

[121] Id.

[122] Jason Simpson, Wealthy Immigrants Could Be Funding The Next U.S. Sports Arenas, OZY (Aug. 20, 2014), http://www.ozy.com/fast-forward/wealthy-immigrants-could-be-funding-the-next-us-sports-arenas/33381.

[123] Id.

[124] Id.

[125] Id.

[126] New Downtown Stadium, Orlando City, http://www.orlandocitysc.com/stadium (last visited Dec. 5, 2016).

[127] Id.

[128] Soccer Stadium Digest Editors, Soccer Stadium Digest (June, 29, 2016), http://soccerstadiumdigest.com/2016/06/orlando-city-sc-now-controls-stadium-land-parcel/.

[129] New Downtown Stadium, supra 124.

[130] Id.

[131] Id.

[132] Don Muret, Roar of Orlando, Source: Orlando City SC, Sports Business Journal (March 13, 2017). http://www.sportsbusinessdaily.com/Journal/Issues/2017/03/13/Facilities/Orlando-City-SC.aspx

[133] Id.

[134] Orlando City Stadium Financing, Wikipedia, https://en.wikipedia.org/wiki/Orlando_City_Stadium#Financing (last visited Aug. 16, 2016).

[135] New Downtown Stadium, supra 124.

[136] Id.

[137] Paul Tenorio, Orlando City Unveils Plans for New $155 Million, 25,500-seat soccer stadium, Orlando Sentinel (July 31, 2015), http://www.orlandosentinel.com/sports/orlando-city-lions/os-orlando-city-stadium-0731-20150730-story.html.

[138] Id.

[139] Id.

[140] Belson, supra note 34.

[141] Id.

[142] Ian Mount, This Could Be the Quickest Way to Get a Green Card, Fortune (May 27, 2016). http://fortune.com/2016/05/17/eb5-visa-green-card-mls/.

[143] Id.

[144] Don Muret, A Small World After All: How visa program helped pay bills, Sports Business Journal (March 13, 2017). http://www.sportsbusinessdaily.com/Journal/Issues/2017/03/13/Facilities/Orlando-City-EB5.aspx.

[145] Id.

[146] Daniel Kaplan & Ian Thomas, Strenth of MLS evident in stadium lending, Sports Business Journal (February 20, 2017). http://www.sportsbusinessdaily.com/Journal/Issues/2017/02/20/Finance/MLS-stadium-lending.aspx.

[147] Id.

[148] Belson, supra note 34.

[149] Id.

[150] Belson, supra note 34.

[151] Id.

[152] Frank Shyong, Visa Program for wealthy investors maxed out by Chinese demand, Los Angeles Times (Aug. 29, 2014), http://www.latimes.com/local/la-me-0830-chinese-visas-20140830-story.html.

[153] Invest LA Regional Center, Investlaeb5, http://www.investlaeb5.com/projects.html (last visited Sept. 28, 2016).

[154] Belson, supra note 34.

[155] Kevin Reichard, Orlando City SC: Attracting Stadium Capital with Visas, Soccer Stadium Digest (May 17, 2016), http://soccerstadiumdigest.com/2016/05/orlando-city-sc-attracting-stadium-capital-with-visas/.

[156] Belson, supra note 34.

[157] Id.

[158] Id.

[159] Id.

[160] Id.

[161] Id.

[162] Id.

[163] Id.

[164] ESPN Staff, Orlando City Offering Green Cards for Investments in Planned Stadium, ESPN FC (May 17, 2016), http://www.espnfc.us/orlando-city-sc/story/2874912/orlando-city-offering-green-cards-for-investments-in-planned-stadium.

[165] Belson, supra note 34.

[166] Some Orlando City Soccer stadium funding in limbo, WFTV ABC9 (Apr. 23, 2015), http://www.wftv.com/news/local/plans-orlando-city-stadium-could-be-stalling/69615062.

[167] Reichard, supra note 153.

[168] New Downtown Stadium, supra 124.

[169] Belson, supra note 34.

[170] Reichard, supra note 153.

[171] Stephen Hudak, Parramore Plan Seeks to Improve City’s Poorest Neighborhood, Orlando Sentinel (Feb. 14, 2015), http://www.orlandosentinel.com/news/orange/os-orlando-parramore-future-20150214-story.html.

[172] United States Unemployment Rate, Trading Economics, http://www.tradingeconomics.com/united-states/unemployment-rate (last visited Oct. 2, 2016).

[173] Ian Mount, This Could Be The Quickest Way to Get A Green Card, Fortune (May 17, 2016), http://fortune.com/2016/05/17/eb5-visa-green-card-mls/.

[174] Kartik Krishnaiyer, Orlando CS privately-financed stadium deal paves way for MLS expansion teams, World Soccer Talk (May 31, 2015), http://worldsoccertalk.com/2015/05/31/orlando-city-sc-privately-financed-stadium-deal-paves-way-for-mls-expansion-teams/.

[175] Michael Rosenberg, The Super Bowl That Tore A Family Apart, Forever Changed Stadium Deals, Sports Illustrated (Nov. 23, 2015), http://www.si.com/nfl/2015/11/24/miami-dolphins-super-bowl-joe-robbie-stadium.

[176] Belson, supra note 34.

[177] Neil deMause, Orlando’s MLS Stadium Deal Not as Taxpayer-Friendly as Reported, Still Better Than A Poke in The Eye, Field of Schemes (March 14, 2016), http://www.fieldofschemes.com/2016/03/14/10768/orlandos-mls-stadium-deal-not-as-taxpayer-friendly-as-reported-still-better-than-a-poke-in-the-eye/.

[178] Id.

[179] Id.

[180] Id.

[181] Neil deMause, Orlando soccer stadium has raised $15m via the old green-card-for-investment scam, Field of Schemes (May 18, 2016), http://www.fieldofschemes.com/category/mls/orlando-city-soccer-club/.

[182] Laura Saunders, Are The Green Bay Packers The Worst Stock in American, WSJ (Jan. 13 2012), http://blogs.wsj.com/totalreturn/2012/01/13/are-the-green-bay-packers-the-worst-stock-in-america/.

[183] Id. Also, Belson, supra note 34.

[184] Id.

[185] Saunders, supra note 180.

[186] Belson, supra note 34.

[187] Saunders, supra note 180.

[188] Belson, supra note 34.

[189] Id.

[190] Belson, supra note 34.

[191] Erin Kelly, Congress Reaches Deal on 2016 Spending Bill to Fund Federal Government, USA Today (Dec. 15 2015), http://www.usatoday.com/story/news/2015/12/15/congress-nears-deal-2016-spending-bill-fund-federal-government/77353838/.

[192] Chris Fuchs, Congress Likely to Extend Controversial Investment Visa Program, NBC News (Dec. 17, 2015), http://www.nbcnews.com/news/asian-america/congress-likely-extend-controversial-investment-visa-program-n481751.

[193] Jim Butler and the Global Hospitality Group, EB-5 Regional Center program extended until December 9, 2016 by Continuing Resolution, HotelLawBlog.com (Oct. 3, 2016), http://hotellaw.jmbm.com/eb-5-regional-center-program-extended-december-9-2016-continuing-resolution.html.

[194] Id.

[195] Id.

[196] Viji Durgan, EB-5 Program Gets Temporary Extension; USCIS Issues New EB-5 Policy Manual, EB5News.com (Dec. 13, 2016), http://eb5news.com/categories/9-general/posts/1035-eb-5-program-gets-temporary-extension-uscis-issues-new-eb-5-policy-manual.

[197] Id.

[198] Id.

[199] Id.

[200] Cathaleen Chen, EB-5 will thrive under Trump, advocates say, TheRealDeal.com (Nov. 18, 2016), http://therealdeal.com/2016/11/18/eb-5-will-thrive-under-trump-experts-say/.

[201] Sheng, supra note 79.

[202] Id.

[203] Kenneth Rapoza, Why Congress Will Extend The EB-5 Immigrant Visa Program, Forbes (Sep. 27, 2016), http://www.forbes.com/sites/kenrapoza/2016/09/27/why-congress-will-extend-the-eb-5-immigrant-visa-program/#3545a5026344.

[204] Id.